How to Go to College for Free: 12 Strategies

What’s Covered:

As of 2018, the average student loan debt per graduating student in the US is $29,200. Over 45 million Americans face student-loan debt, sharing in the US student debt total of a record $1.6 trillion as of 2020. Compared to their parents, millennials and Gen Z will pay at least 300% more for their college education. According to the US Department of Education, those with debt between $20,000-$40,000 will take 20 years to pay them off.

Sounds a little bleak, huh? Is it even still possible to hope for a college education for little to no cost? Well, yes, but it’s getting progressively more difficult.

For those of us not lucky enough to have a fully-stocked 529 or trust fund, getting free college involves work. There are many applications and hoops to jump through, but if you jump just right, you can earn your degree for (just about) free. Seriously.

Before you start figuring out your strategy, remember this: be realistic. For instance, lower-income students will have more options for free college through financial aid than students from middle-to-upper income families. If you’re not a low-income student, don’t bank on financial aid to get you through. Likewise, scholarships based on merit and academics are largely awarded to very strong students. If you’re not a strong student, don’t bank on merit scholarships. Know your strengths and weaknesses, and use them to craft a strategy that works specifically for you. Wanna know how to go to college for free? Let’s get into it.

12 Ways to Go to College for Free

1. Apply to Schools that Meet 100% Demonstrated Need

Demonstrated financial need is how much money you or your family will need to cover the full cost of your college attendance. This number is based on your expected family contribution (EFC) and the actual cost of attending the school. Your EFC is calculated using your parent’s information as reported on the FAFSA. Even if your family is not contributing to your college costs, the EFC is factored in. So, if the FAFSA determines your EFC to be $20,000 a year, and your college costs $50,000 a year, a school committed to meeting 100% of demonstrated financial need would have to offer you a financial aid package worth $30,000 a year. If your family is not contributing, you will have to find other ways to make up the rest for a fully free college degree.

Some schools that meet 100% demonstrated need include Brown University, MIT, University of Pennsylvania (UPenn), and Yale. There are other, highly selective schools that offer free tuition for low-income students. These include Columbia, Dartmouth, Duke, Northwestern, and Princeton. Most of the students offered this option have primarily A’s in the most challenging classes available to them, and typically come from households earning less then $65,000 for a family of four.

2. Consider QuestBridge (reserved for low-income students)

QuestBridge partners with 40 colleges and universities in the United States offering the National College Match Scholarship. It covers the full cost of attendance for each school, including tuition, room and board, travel expenses, books, and supplies. This is with NO parental contribution and NO student loans! However, the student may have to contribute through a work-study or their own savings.

Many schools offer work-study programs, in which a student will work part-time while enrolled in the school and be paid funds that can be used for tuition, fees, and room and board, along with other expenses. To see if your school participates, check out their Financial Aid Office, or Financial Aid Office website. While working, you will have to maintain satisfactory academic progress to continue in the program, which is determined by the individual school.

To be eligible, students must be high school seniors and US citizens or permanent residents. High school students in the US who are neither can still apply, but not all college partners will consider them. Students must also demonstrate a high level of academic achievement, including primarily A’s in challenging courses, SAT or PSAT scores over 1310, and ACT scores over 28. Students from households earning less than $65,000 can apply online on the QuestBridge website.

3. Apply for Full-Ride Scholarships

Some colleges offer full-ride scholarships , particularly for high-achieving, low-income students. With a full-ride scholarship, all costs of attendance are covered, including housing, meals, transportation, and books. Full-tuition scholarships are similar but do not cover living expenses. Many schools that offer these scholarships use them as recruitment tools to attract competitive students. As a school goes up in rank, full-ride scholarships become harder to find.

Some schools that offer full-ride scholarships include:

- Duke University

- Vanderbilt University

- University of Notre Dame

- Virginia Tech

4. Ace the SAT/ACT

Some schools give automatic merit scholarships, which can be full-tuition or full-ride! These scholarships do not require an application, just certain GPAs or SAT/ACT scores. Here are some examples:

- Alabama’s Presidential Academic Scholarship: Full Ride

- Clemson’s Trustee Scholarship: $1,000 in-state, $7,500 out-of-state

- Howard’s Presidential Scholarship: Tuition, Fees, Room, Board, $950 Book Voucher, and Laptop

- Texas State’s President’s Honor Scholarship: $26,000-$38,000

- Tuskegee’s Distinguished Presidential Scholarship: Full tuition, room and board, and $800 for books

5. Apply for Outside Scholarships

Here are some handy lists of scholarships you can apply for:

- 10 Great Scholarships for Business Majors

- 10 Engineering Scholarships for High School Students

- 10 Generous Scholarships for Low-Income Students

- 10 Scholarships for Hispanic and Latino/Latinx Students

- 10 Awesome Scholarships for Education Majors

- 10 College Scholarships for Students with Disabilities

And there are more great scholarships available to you! In fact, CollegeVine also offers scholarships!

CollegeVine awards scholarships of up to $500 every week! All you have to do is make a free account. When you make your account, you will do tasks to earn karma, CollegeVine’s free “currency”. You can earn karma by reviewing essays through our Peer Review tool and answering questions in our Community Forums. Once you’ve earned your karma, you can bid it to enter the scholarship drawing each week. If you don’t win, the karma goes straight back to your account. It’s a win-win! Awards are paid out directly to students to help cover educational costs. Learn more about our scholarships and start applying!

6. Look at Grants for Students of University Faculty

Some colleges offer free tuition or tuition assistance if you or your parents work there. Along with other scholarships, these programs can get you to your free college goal! For instance, Duke University offers the Children’s Tuition Grant Program, in which employees are provided a grant for their child’s undergraduate expenses at any accredited college or university, not just Duke itself.

7. Have Your Employer Pay

Sometimes, employers will assist their employees in paying for college. They do this to increase the skill level and productivity of employees; encouraging longevity and reducing turnover, and sometimes, lowering their tax bill. Per the US IRS, an employee can receive up to $5,250 from their employer toward college before having to report it for taxes. Most of the time, the employee will have to sign a contract with stipulations for the money. Before signing, be sure you have read and understood the contract fully, so there are no surprises later. Some companies that offer tuition assistance programs include:

- Wells Fargo

- Bank of America

- AT&T

- Chevron

Plenty of other companies offer programs as well. Check to see if your company has one!

8. Consider Loan Forgiveness Programs

Before you get excited, these programs often have strict requirements, and if they are not followed, you forfeit the forgiveness. Don’t bank on these if you are unsure of what you want to do and if you’ll be able to fulfill the obligations. Many of these programs serve students entering in-demand fields and serving certain communities. Here are some examples:

- Public Service Loan Forgiveness : PSLF will forgive the remaining balance on your Direct Loans once you’ve paid 120 payments under a qualified repayment plan while working for a qualified employer.

- Teacher Loan Forgiveness : This program will forgive up to $17,500 on your Direct Loan of FFEL Program loans so long as you teach full-time for five complete and consecutive academic years in a low-income elementary school, secondary school, or educational service agency.

- Perkins Loan Cancellation and Discharge : Based on your employment or volunteer service or certain conditions, you may be able to have all or a portion of your Perkins Loan canceled or discharged.

9. See if Your State Offers Free Community College

Some states offer free tuition at community college, which is a great way to earn a degree or general education credits toward a bachelor’s degree. Many credits transfer over, and you’re able to get them at a very discounted (or FREE!) price! Some states that offer free community college include:

- Arkansas

- California

- Delaware

- Hawaii

- Indiana

- Kentucky

- Maryland

- Montana

- New York

10. Attend a Tuition-Free College

They do exist! Tuition-free colleges are schools that do not charge tuition, and may also not charge students for fees, room and board, and other expenses. The definition of “tuition-free” depends on the school. Here are some examples of schools that offer “tuition-free” programs for qualified students:

- Alice Lloyd College

- The University of North Carolina at Chapel Hill

- Antioch College

- Barclay College

- Berea College

- Webb Institute

11. Attend a Work College

Work colleges are four-year, liberal arts institutions emphasizing the importance of work, learning, and service. They require students to hold a job (usually on-campus) for all four years of their enrollment. Each school has varying requirements for these, and all are overseen by the Department of Education. Some examples of work colleges include:

- Alice Lloyd College

- Berea College

- Bethany Global University

- Blackburn College

- College of the Ozarks

- Paul Quinn College

- Sterling College

- Warren Wilson College

12. Minimize Living Costs

First, once again, make sure you are applying to colleges that are within a realistic budget. Another way to cut your costs is considering community college like we mentioned above. Aside from those, here are some tips on cutting down your costs:

- Utilize your meal plan to the fullest extent: You’re already paying for it. Use it! Don’t go to the fast food places around campus all the time. Don’t spend a bunch on groceries. Your wallet will thank you.

- Live off-campus if possible: Dorm rent is notoriously expensive. Try looking for apartments with roommates close to campus.

- Use online resources like SlugBooks to find the cheapest textbooks, or check them out at the library and photocopy them.

- Take advantage of all the student discounts you can find!

How Much Will College Cost Your Family?

How much college costs depend on a lot of factors, including financial aid, tuition assistance, and scholarships. Remember, many schools with generous financial aid are also very selective, so it’s important to have a balanced college list to make sure you get into at least one fitting your budget. Before you spend the money to apply to a school, even if it sounds like a wonderful place, you need to make sure it is affordable. You don’t want to get into a school only to realize you can’t pay for it! Now that you know how to go to college for free, make the strategies above work for you!

The amount of aid you will receive depends on the specific formulas used by a college’s financial aid office, and your general profile. You must reapply for financial aid every academic year, which accounts for variances in the amount of aid you receive in a given year. It can go up or down, but as long as your family’s financial situation stays stable your aid should too.

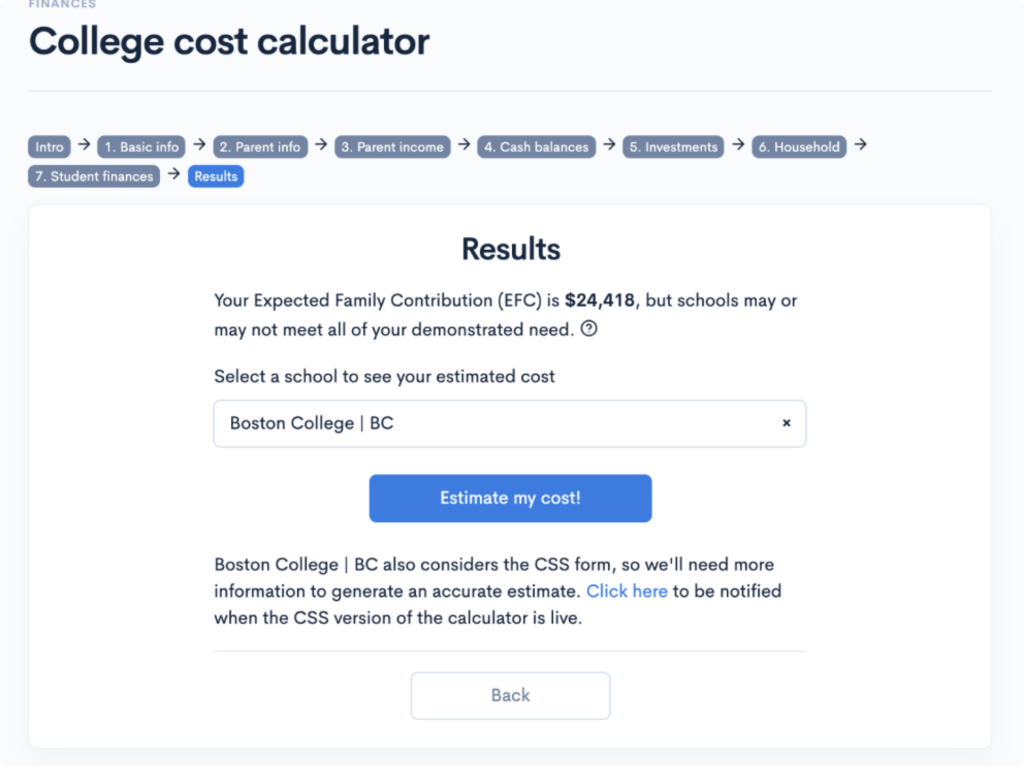

Still not sure about how much financial aid you’ll receive? Instead of manually inputting your information into multiple price calculators, check out our free Financial Aid Calculator. It can give you an estimate for hundreds of schools in just three minutes. The Financial Aid Calculator is a great way to figure out how to go to college for free. When you sign up for a free account, you will also be able to tell your chances of acceptance based on grades, test scores, extracurriculars, and more with our Admissions Chancing Engine!