Complete Guide to Applying for College Financial Aid

What’s Covered:

- Types of Financial Aid

- How Does Financial Need Impact Admissions?

- Who Should Apply for Financial Aid?

- How to Apply for Need-Based Financial Aid

- Which Schools Give the Most Financial Aid?

- Understanding Your Financial Aid Offer

- How Much Aid Will You Receive?

Figuring out financial aid can be a challenge. But we’re here to help! For many students entering college, financial aid is a must. It can help ease the burden of college costs, which allows students to focus on their studies. This post covers the types of financial aid, how aid can impact your admissions, who should apply to the different scholarships and programs, how to apply for financial aid, and more!

Prefer to watch a video? Check out this financial aid livestream by our co-founder.

Types of Financial Aid

There are two umbrella terms for financial aid—merit-based and need-based.

- Merit-Based Financial Aid: Merit scholarships are offered based on a student’s total academic profile. These awards are usually controlled by the admissions office. Merit scholarships can be used as a recruitment tool, particularly for schools that are less selective; these schools distribute a lot of merit aid (up to >60% of students!)

- Need-Based Financial Aid: This type of aid is offered based on a family’s financial needs. These awards are usually controlled by the financial aid office. Need-based aid can also be used as a recruitment tool for all types of schools.

Colleges use aid as a social and business incentive to enroll. Financial aid supports less fortunate students, which promotes a more diverse and well-rounded campus. Providing aid bolsters the social impact of a college on its community. On the business side, colleges attract students by leveraging the aid they can provide. At very selective colleges, the social incentive is usually dominant. In contrast, the business side is emphasized at less-selective schools.

In this post, we’re going to focus on need-based aid. In general, “financial aid” refers to need-based aid during the admissions process. Conversely, merit-based aid is referred to as scholarships.

How Does Financial Need Impact Admissions?

This depends on the type of school you are applying to and the intricacies of their financial aid office policies.

- Need-blind schools: These aid packages are based on the family’s financial needs and controlled by the financial aid office. They do not impact a student’s admissions prospects or process! However, most need-blind schools are need-aware for international students.

- Need-aware schools: Aid packages are offered based on your profile and controlled by the admissions office. This doesn’t mean you are hindered from acceptance if you are middle or lower class, rather you are more likely to receive an acceptance without aid than outright rejection. If you fall under the average range for the admissions criteria at one of these schools, then it is safer to not apply for financial aid to be admitted, if you can afford it.

Just remember, no school is fully need-blind. Admissions officers can see if you applied for aid on the Common App, but don’t let that scare you! If you require need-based financial aid, make sure you apply without fear of it impacting your admission.

Who Should Apply for Financial Aid?

Um, who likes getting a discount on goods and services? Everybody? That’s who needs to apply for financial aid! Even if you don’t think you’ll be approved, it never hurts to try. Even upper-middle-class families can receive aid, particularly at private schools.

How to Apply for Need-Based Financial Aid

There are three big types of aid—federal, state, and institutional.

- Federal: Paid for by the federal government.

- State: Paid for by state and local government.

- Institutional: Paid for by the college out of its budget.

For any type of aid, you will need to fill out the required applications, submit financial forms for verification, and negotiate your offers. We’re going to go over how to apply for financial aid with the most well-known and commonly-used examples: the FAFSA and a CSS profile.

The FAFSA

Free Application for Federal Student Aid (FAFSA) is free to apply to, and determines federal aid at all schools. The FAFSA also can determine institutional aid at non-CSS schools. To complete the FAFSA you will need to:

- Input information about your parent’s income, assets, and circumstances; even if they are not helping you pay for school.

- The FAFSA takes into account your own financial situation, as well as your age, family situation, and siblings in college.

- If you have divorced parents, the FAFSA will only take into account your custodial parent’s income and assets, as well as any spouse of your custodial parent.

-

Consider the formula:

- (20% x Household disposable income) + (20% x Student assets) + (5% x Available parent assets)

- Household disposable income: Parent income + student income – $50,000

- Protected assets include 401(k) plans, health savings accounts, primary residence value, and a small family business or farm.

It is crucial that you note the FAFSA deadlines! For the 2021-22 academic year, your FAFSA application must be submitted by 11:59 p.m. CT on June 30, 2022. If you need to make any corrections or updates to the application, they must be done by September 10, 2022. Specific state and college deadlines may vary. Most colleges require that you submit the FAFSA at the time of application to give you a financial aid award upon acceptance.

CSS

The College Scholarship Service (CSS) is a profile managed by the CollegeBoard and is used by over 300 (mostly private) schools for institutional aid. Students can build this profile to help determine the institutional aid they may be eligible to receive. It costs $25 to create a CSS profile, though there are fee waivers. The formula used is harsher than that used by the FAFSA, but it does consider more information. When completing your CSS profile you should consider that:

- The CSS reviews both financial and non-financial circumstances, such as income, savings, investments, property, age, family situation, etc.

- If you have divorced parents, CSS will consider assets from both your custodial and non-custodial parents, as well as any spouses they may have.

-

Consider the formula:

- (20% x Household disposable income) + (20% x Student assets) + (6% x Available parent assets)

- Unprotected assets include housing equity, and a small family business or farm.

It is important to note the CSS deadlines! For the 2021-22 academic year, the opening date was October 1, 2020. The deadline for the application varies based on each school. Usually, schools set their deadlines between January 1 and March 31.

Which Schools Give the Most Financial Aid?

Now that you know how to apply for financial aid, you should know that schools are incentivized to give out aid. They want to give you money! Schools determine aid awards in two ways:

- As a recruiting tool: This happens at most schools, even those that are “need-blind”. Colleges bring in students with strong academic profiles; better than average students at the school. Each school uses their own formula when deciding these packages.

- As leverage: In this case, schools offer small amounts of money to students who would most likely pay full or near-full price to encourage their enrollment. This practice has become increasingly common. The goal is to get as many enrollments as possible at the reservation price; the highest price a student is willing to pay to attend the school.

Some schools go above and beyond in making sure all admitted students are able to attend, regardless of their financial situation. These schools meet 100% of your demonstrated financial need. To calculate your demonstrated financial need, subtract the estimated family contribution to your education from the cost of attendance of your school. These packages can include grants, work studies, and loans. For many of these, you will need to maintain good academic standing, check in every year with a financial aid counselor, and possibly work a job on campus.

Here are some schools that meet 100% demonstrated need with NO LOANS:

- Amherst College

- Bowdoin College

- Brown University

- Colby College

- Columbia University

- Davidson College

- Harvard University

- Massachusetts Institute of Technology

- Northwestern University

- Pomona College

- Princeton University

- Stanford University

- Swarthmore College

- University of Chicago

- University of Pennsylvania

- US Air Force Academy

- US Naval Academy

- Vanderbilt University

- Washington and Lee University

- West Point

- Yale University

Some schools will meet 100% of financial need without loans so long as you are within a certain income threshold. These schools include:

- Cornell University

- Dartmouth College

- Duke University

- Haverford College

- Rice University

- Vassar College

- Washington University in St. Louis

- Wellesley College

- Williams College

Understanding Your Financial Aid Offer

First, we will go over some terms:

- Grants: Awarded from the federal or state government, your school, or a private/nonprofit organization. These awards do not have to be repaid.

- Work Study: These are part-time jobs for students with need-based financial aid packages. These programs allow you to earn money for your education. Usually, these jobs emphasize community service and work related to your major.

- Loans: This is money you are borrowing that must be paid back with interest. They can come from the federal government, banks or other financial institutions, or other organizations. Usually, federal loans have greater benefits than other loans. In general, students will not begin making payments towards these loans until several months after graduation.

Now, let’s talk about the parts of your financial aid offer.

- The cost of attendance (COA) is an estimate of what you will pay to attend the school for the year. This includes tuition and fees, campus housing, estimated costs of books and supplies, and other expenses.

- The Expected Family Contribution (EFC) is the number used to determine how much aid you are eligible to receive. Even if your parents are not helping you pay for college, this number is taken into account when calculating your financial aid package.

- Your financial aid offer will indicate the grants, scholarships, and work-study programs you are eligible for, and the federal student loans you have access to.

Keep in mind that different universities will meet different percentages of your demonstrated need. So, you should expect to see varying financial aid offers. Many of these offers will be a mix of grants, work-study programs, and federal loans. Remember, you will need to subtract the loan amount when calculating your net cost of attendance.

How Much Aid Will You Receive?

The amount of aid you will receive depends on the specific formulas used by a college’s financial aid office, and your general profile. You must reapply for financial aid every academic year, which accounts for variances in the amount of aid you receive in a given year. It can go up or down, but as long as your family’s financial situation stays stable, your aid should too.

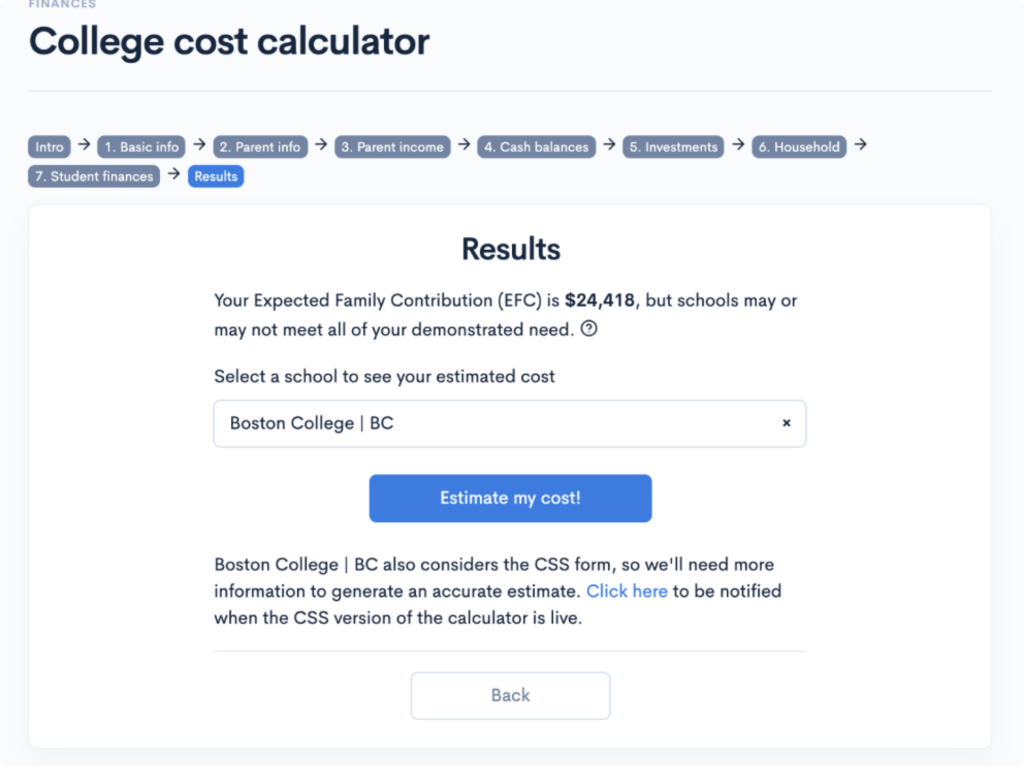

Still not sure about how much financial aid you’ll receive? Instead of manually inputting your information into multiple price calculators, check out our free Chancing Engine. It can give you an estimate for hundreds of schools in just three minutes. When you sign up for a free account, you will also be able to tell your chances of acceptance based on grades, test scores, extracurriculars, and more!