How to Find Affordable Colleges as a Middle-Class Student

The price of attending college has more than doubled since the 1980s. Luckily, the vast majority of students today receive some form of financial aid (89%, as reported by Paul Trough in The New York Times Magazine in 2019). While many students in the lower-income bracket receive substantial financial aid packages, even full rides in some cases, and students in the upper-income bracket can often afford the ticket price, middle-income students sometimes find that their awards don’t fully meet their needs. If you’re concerned about paying for college as a middle-class student, don’t worry: there are many options available. According to the Pew Research Center, approximately 52% of U.S. adults lived in middle-income households in 2018. The study defines middle-income households as those with incomes ranging from $48,500-$145,500 for a family of three. This, of course, is a huge range, and the relative income is also variable by factors like location and cost of living in that area (which colleges generally don’t account for). Moreover, students in lower-income brackets often have plenty of grants available to them, such as the Pell Grant, which is awarded to students with “exceptional financial need.” Middle-class students, meanwhile, have less demonstrable financial need, but with the rising cost of higher education, many cannot still not afford to pay the prices, even with financial aid. Luckily, there are some better options for students in the middle class. Here are some of the more affordable colleges for these families. A good handful of top-tier schools are committed to meeting 100% of demonstrated financial need for all accepted students. This means that the schools will cover the difference between the cost of attendance and your expected family contribution (EFC), often through grants, loans, or work-study. The following schools meet full demonstrated need and are even no-loan, meaning that you’ll only receive grants in your financial aid package (and sometimes federal work-study). These schools are also need-blind, so your financial need won’t be a factor in your admissions decision. In some cases, these colleges could be cheaper than in-state public schools after financial aid — even free for lower-middle-class students in certain situations. A handful of these schools even specifically state that families making under a certain amount are required to pay nothing. Here are some of these schools: Full ride for students with families making under $65,000 per year (generally, these numbers refer to a family of four with typical assets). Families with incomes between $65,000 and $150,000 will contribute from 0-10% of their income. Full ride for students with families making under $54,000 or less per year. Free tuition for students with families making under $120,000 per year. Full ride for students with families making under $65,000 per year. Free tuition for students with families making under $125,000 per year. Full ride for students with families making under $60,000 per year. Free tuition for students with families making under $125,000 per year. Full ride for students with families making under $65,000 per year. Students with families making under $150,000 per year will pay no more than $15,000. Bear in mind that even these schools that meet 100% need may vary in terms of their generosity. Different schools use different algorithms for calculating financial need, and you could receive offers that differ by thousands of dollars. To get an idea of what you’ll be expected to pay, make sure to use the net-price calculators on colleges’ financial aid pages. Merit scholarships aren’t awarded based on income but academic and extracurricular performance and achievements. Still, middle-class students can still receive significant merit scholarships. For instance, National Merit finalists can get a full ride at the University of Alabama. Meanwhile, additional colleges offer substantial scholarships and, in some cases, full rides to students based on their SAT or ACT scores. At Alabama State University, for example, the Presidential Academic Scholarship is awarded to students with at least a 3.76 GPA and 26 on their ACT or 1240 on their SAT. This scholarship covers the student’s education. Other institutions award full-ride or full-tuition scholarships based on a more holistic review of students’ academic achievements. For instance, Duke University and University of North Carolina at Chapel Hill students may participate in the Robertson Scholars Leadership Program, which covers tuition, mandatory fees, and room and board for four years. The scholarship is awarded based on leadership, intellectual curiosity, strength of character, and collaborative spirit. For students in the upper-middle class, in-state public schools are often the cheapest options. Many students in this category won’t qualify for substantial financial aid packages at private schools, and even with some aid, education is often a significant fraction of their total family income. In-state public universities can be much more affordable, and many institutions also award substantial merit scholarships. If you want to save even more money, you could consider starting at a community college, and then transferring to a four-year university. Some state universities have guaranteed transfer programs with their local community colleges. Be aware that most colleges with the best financial aid awards tend to be highly selective. We recommend applying to a balanced list of 8-12 schools, with 25% being safety schools, 40% target schools, and 35% reach schools. For middle class students, finding target schools that are viable financially is a lot trickier, as target schools often don’t offer as generous of aid. In this case, you may consider applying to a mix of more safety or “hard target” schools. Wondering how to find the best, affordable colleges? Using CollegeVine’s free chancing engine, you can estimate your cost of attendance at particular colleges and get tips for improving your profile for success. We’ve made it easy to create a balanced and financially-sound list of best fit schools.

What’s Covered:

Why Is College So Expensive for the Middle Class?

Colleges With Best Financial Aid for the Middle Class

1. Colleges that Meet 100% Need

2. Colleges with Merit Scholarships

3. In-state Public Schools

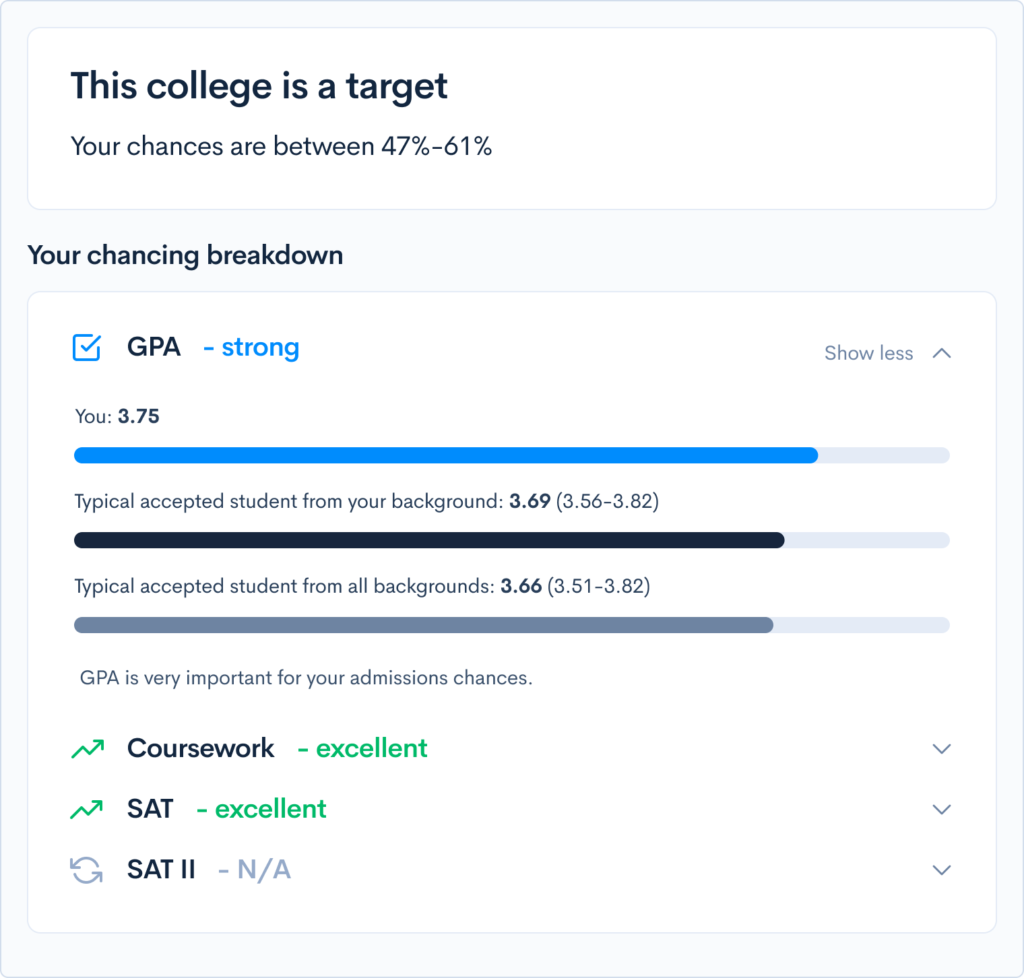

How to Find Affordable, Best-Fit Colleges