How Much Does College Cost on Average? How to Save Money

What’s Covered:

- What Are Average College Tuition Costs?

- What About Other College Costs?

- How Has the Cost of College Changed Overtime?

- Strategies to Save Money on College

- How Much Will College Cost Your Family?

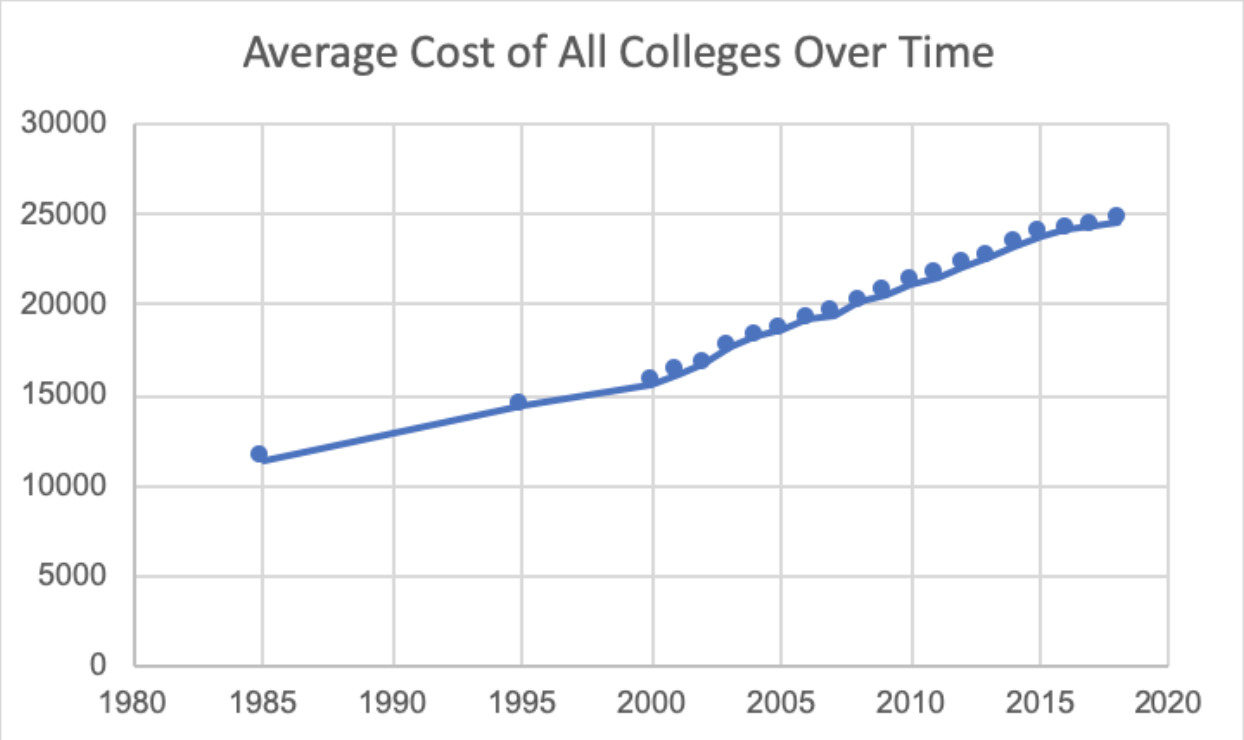

It’s no surprise that college can cost a lot of money. The cost of college tuition has increased dramatically and even doubled since the 1980s. The nationwide student-loan debt is over $1.5 trillion, and college is only projected to become more expensive.

Although the price of college continues to rise, there are some effective ways to save money. In this post, we’ll cover the average cost of college as well as some tips on how to make college more affordable.

What Are Average College Tuition Costs?

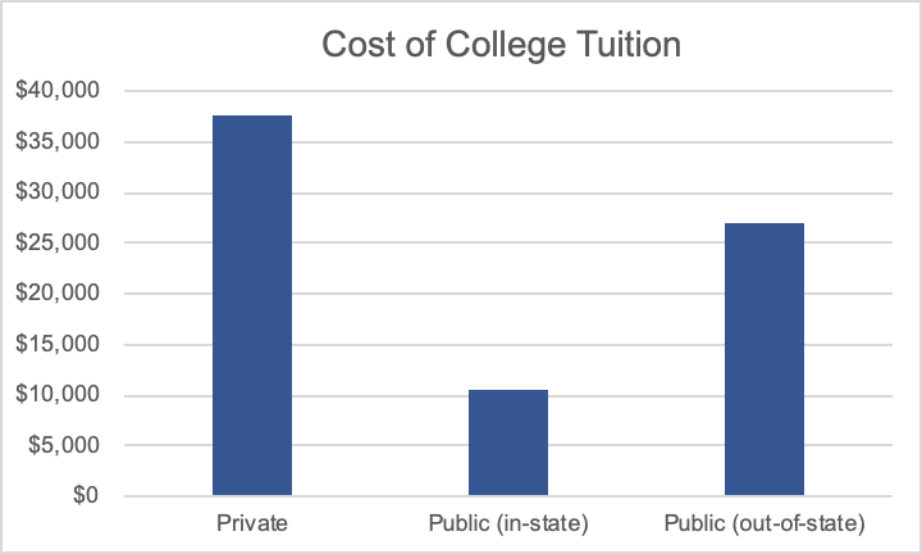

On average, tuition costs are $37,650 at private colleges, $10,560 at public colleges for in-state residents, and $27,020 at public colleges for out-of-state residents. While these are the average sticker prices, what you actually pay depends on your family’s financial situation. For instance, while private colleges have the highest sticker price, financial-aid packages can make their costs comparable to, or even less than, a public school.

Keep in mind that college tuition describes only the cost for college classes–this does not cover other costs you may have, such as living expenses.

What About Other College Costs?

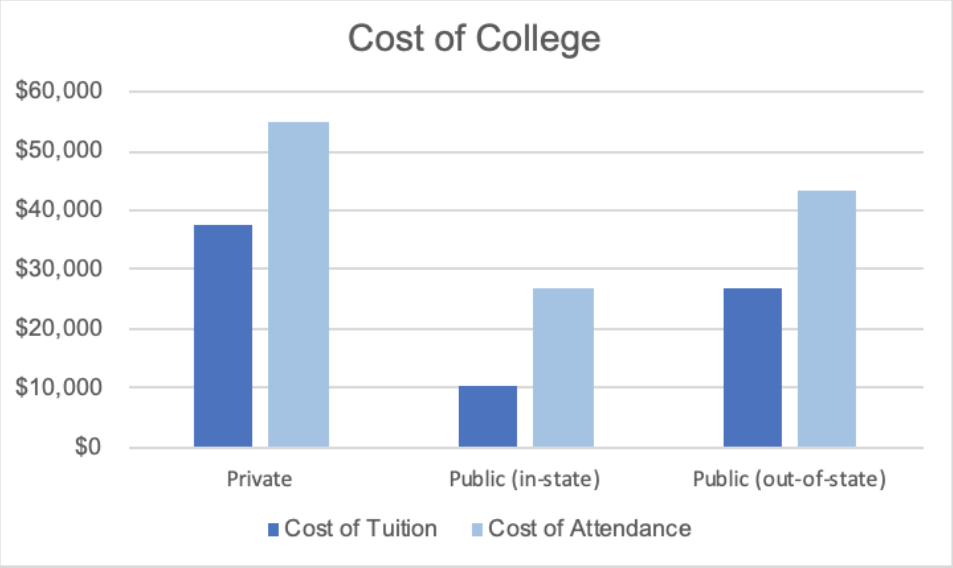

Cost of Attendance (COA) is a slightly different value that includes tuition, room and board, school supplies, and other expenses such as transportation and healthcare. For the 2020-2021 academic year, the average cost of attendance was $54,880 at a private college, $26,820 at an in-state public college, and $43,280 at an out of state public college.

The chart below shows a breakdown of the different expenses included within the total COA. According to The College Board, these prices reflect average costs during the 2020-2021 academic year.

|

Private |

Public (In-State) |

Public (Out of State) |

|

|

Tuition |

$37,650 |

$10,560 |

$27,020 |

|

Room and Board |

$13,120 |

$11,620 |

$11,620 |

|

Books and Supplies |

$1,240 |

$1,240 |

$1,240 |

|

Transportation |

$1,060 |

$1,230 |

$1,230 |

|

Other expenses* |

$1,810 |

$2,170 |

$2,170 |

|

Total COA |

$54,880 |

$26,820 |

$43,280 |

*entertainment, clothing, and other personal expenses

While private colleges typically have higher sticker prices overall, you’ll notice the average costs for transportation and other personal expenses are actually lower for students who attend private colleges. Also, the average cost for books and supplies is the same across all colleges, however it will vary depending on the classes you take.

Again, keep in mind that these average costs are just sticker prices. Your actual expenses will vary depending on your financial aid and/or scholarships, as well as your college lifestyle.

How Has the Cost of College Changed Overtime?

The cost of college today is much higher than it has ever been, and it is only projected to increase. According to the National Center for Education Statistics, in 1980, the average cost of college at any university was $11,369. Today, that cost is $26,740. In less than 50 years, the cost of college has almost tripled.

Strategies to Save Money on College

1. Apply for schools that meet 100% of demonstrated need

Many schools across the U.S. meet 100% of demonstrated need. Demonstrated financial need is the difference between your Expected Family Contribution (EFC), the amount your family is able to pay based on your financial situation, and the total Cost of Attendance (COA). This means that these colleges are willing to provide aid that will fill whatever you and your family are unable to provide. Other colleges that do not meet 100% of demonstrated need could also provide you with financial aid, but it may not satisfy your full needs.

2. Aim for merit scholarships

Merit scholarships presented by specific universities can provide you with substantial college tuition money without considering your financial needs. You may even be eligible for scholarships based on your ACT/SAT scores.

When you apply for merit scholarships, don’t just apply for everything you see–instead, take time to apply for scholarships that fit your profile and take enough time to craft your story in your application. Learn more about applying for merit scholarships here.

3. Consider outside scholarships

Other than school-specific scholarships, there are scholarships sponsored by various organizations with partial or full tuition funding. While these are great options, always apply for merit aid from schools first, as they usually have more aid to give out.

If you’re looking for some quick scholarship money for college, look no further. CollegeVine provides $500 scholarships weekly! All you have to do is make a CollegeVine account and earn “Karma”, the CollegeVine currency. To earn Karma, review essays through our Peer Review Tool and answer questions on the Community Forum. Afterwards, you will be entered to win in a scholarship drawing of $500 that can be used for college tuition and fees.

4. Attend a nearby public school

It is no surprise that public schools are cheaper than private schools, and being an in-state resident at your local public school can save you lots of money. Typically, in-state public schools are generous with additional scholarship funding as well, as taxpayer dollars go to higher education so these schools are well-funded.

5. Live at home

Living costs at universities can be exorbitant. At public colleges, students living on campus pay on average $11,620 annually and those living off campus pay $10,781 annually. At private schools, these prices are slightly higher. You may want to consider living at home to save this money, therefore reducing student loans.

6. Start at a community college

Starting at a community college has become increasingly popular due to the rising costs of college. In fact, 30% of community college students transfer to a four-year program. This might be a good option for you if you want to get general class requirements out of the way or don’t feel prepared to go to a four year institution. If you’re considering this option, look into our list of considerations on going to a community college.

How Much Will College Cost Your Family?

There is no doubt that college is expensive, but it doesn’t have to be unaffordable. The “sticker price” of a college is also not always what you pay for college. Instead, take a look at a college’s estimated net costs so you can determine how your financial situation influences what you’ll pay.

Want to know how your college profile will influence your chances of admission? Check out our free chancing calculator! This tool can help you determine colleges that are a great fit for you based on your chances of acceptance, location, and other criteria.

If you’re curious to find out what kind of financial aid you would receive from the schools on your college list, look at our free financial aid calculator. This tool will help you gauge how much different schools will cost based on your financial situation.