What is Financial Aid for College? How Does it Work?

The transition to college is an exciting time for many people, but it can also be quite intimidating. There are numerous things to consider the very moment you begin your college search, from identifying your prospective major to laying out a plan to finance your education. Paying for college can be a huge stressor, however understanding the true costs of attendance and your options when it comes covering those costs is key. Keep reading to learn about the different types of financial aid and how to apply for it! Financial aid can be extremely beneficial to any student, whether you’re from a low-income household or you’re just looking for some extra help covering various college expenses. Many schools offer generous financial aid packages consisting of various forms of aid, with some even promising to meet 100% of your demonstrated need. Though their sticker prices can be a bit daunting at times, plenty of private schools offer generous financial aid packages to prevent costs from being a barrier to attendance. For example, Harvard provides full scholarships for students from families that make under $65,000 per year. In fact, the undergraduate college boasts that 20% of families pay nothing for their Harvard education each year. Unsure whether or not you should apply for aid? Even families making over $150k can get financial aid at some private schools, so it’s never a bad idea to apply for financial aid, unless your family is comfortable covering the full costs of college. Financial aid comes in various forms, some of which you need to repay and others you don’t. A common form of aid that does requirement repayment is a loan. Other types of financial aid, such as scholarships, grants, and work-study programs, don’t have to be paid back. Merit-based aid usually isn’t considered “financial aid” in the conventional sense, as merit aid is not based on need and typically comes in the form of scholarships. These awards are granted based on academic, athletic, musical, or other types of achievements. It’s a common misconception that outside organizations offer the most merit scholarships; the colleges themselves tend to offer the most merit aid. Need-based aid is determined by your financial need, with no regard to your academic or extracurricular achievements. Here are the main forms of need-based aid. Grants Grants are a form of need-based financial aid that do not need to be repaid. Students can receive both federal and institutional grants as part of their financial aid package. Federal grants are typically reserved for students from low-income families, and their amounts depend on your expected family contribution, the cost of tuition at your chosen school, and whether you’re enrolled full or part-time, among other factors. On the other hand, institutional grants are offered by individual schools and come in the form of state or college grants. To be eligible for a state grant, you must be a resident of the awarding state and meet any additional eligibility requirements. College grants are offered by schools themselves and often require the completion of a certain amount of credits and a minimum GPA. At selective private schools, even middle class families can sometimes receive significant grants. Work-Study Federal work-study programs require students to work part-time while enrolled in college. During your work-study, your school directly pays you for your work though your particular job could be on or off-campus. These funds also don’t have to be repaid, and like grants, eligibility for work-study programs requires a certain number of credits each semester and a minimum GPA. Loans Student loans can be intimidating because they have to be repaid (usually with interest) however many students will take on some combination of loans to help finance their education in part. Federal loans, funded by the US Department of Education, have fixed interest rates and don’t move into repayment until after you graduate college. An additional benefit of taking on federal loans is that the government may pay the interest for some loans if you demonstrate need. Private loans are provided by private lenders like SallieMay, CollegeAvenue, and others. While these lenders offer different interest options, be sure to research the protections they offer, as they can come with certain dangers. Lastly, there are institutional loans, which are offered by the college itself as part of a financial aid package. For more detailed information about each type of need-based aid, check out our post A Complete Guide to Need-Based Financial Aid.

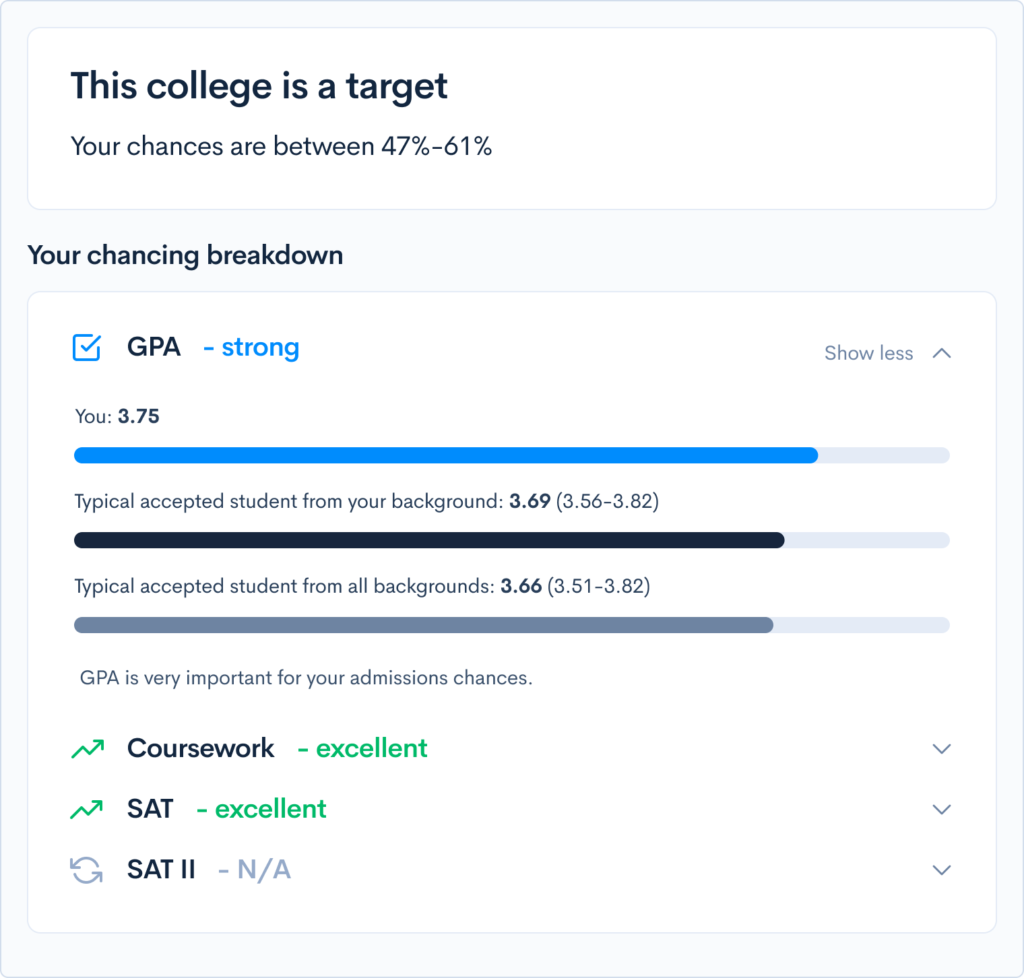

The FAFSA is the main financial aid application and it determines your eligibility for all things federal (grants, work-study programs, and loans). Schools also use it to figure out how much additional need-based aid they can award you. Deadline: June 30th, but the earlier you submit the better! (the application opens October 1st of the previous year) The CSS Profile is administered by the College Board and determines how much institutional aid you can receive. It costs $25 for the first application and $16 for each additional one (but fee waivers are available). Deadline: varies by college (the application also opens on October 1st of the previous year) How to apply: The IDOC, also headed by College Board, is submitted after the FAFSA and CSS Profile. It lets you submit documentation directly to the schools you’re applying to. Schools have to select you for this though, but you’ll be notified via your College Board account! Deadline: depends on the school How to apply: Check out our Guide to Financial Aid for more details on each form. If you’re looking for more info on merit-based aid, the forms and their details can be found on each college’s website. Federal and institutional aid are added to the student’s account as credit and schools are required to give you your grant and loan money once a term – since most schools go by semesters, this is typically twice a year. However, for schools that have trimesters and quarters, they would distribute grant and loan money in installments three or four times a year, respectively. Your school usually will first apply your grant or loan money towards tuition, fees, and room and board (unless you’re off-campus). If you have leftover money, it’ll be paid directly to you. For a work-study program, you’re usually paid once a month, almost like a real job. However, you can ask your school to send payments directly to your bank account or your student account for tuition, fees, and room and board. Outside aid (like private loans and scholarships), on the other hand, varies based on the awarding organization’s rules. You might get a check directly from them or they’ll also send it to your student account. What you can use the money for will change based on the stipulations of the specific program you’re signed up for. This depends on factors like the school you attend and its cost of attendance, your family’s income, assets, and many other things. You can use our net price calculator to see your individual cost estimates for hundreds of schools at once. Federal grants can give anywhere from hundreds to thousands of dollars a year, while loans can go up to $20,500 based on the type. Work-study programs guarantee that you’ll earn at least minimum wage in your state, but again it depends on the job and the specific program. We’ll also show you your chances of acceptance and how to improve your profile. Our free chancing engine can help determine your chances of getting into various schools in addition to your costs of attendance. Sign up for your free CollegeVine account to access these tools today! What’s Covered:

What is Financial Aid? Who Qualifies?

Do You Have to Pay Back Financial Aid?

Types of Financial Aid

Merit-based

Need-Based Financial Aid

How to Apply for Financial Aid

Free Application for Federal Student Aid (FAFSA)

CSS Profile

Institutional Documentation Service (IDOC)

How is Financial Aid Disbursed?

How Much Financial Aid Will You Receive?