Grants vs. Scholarships vs. Loans: What’s the Difference?

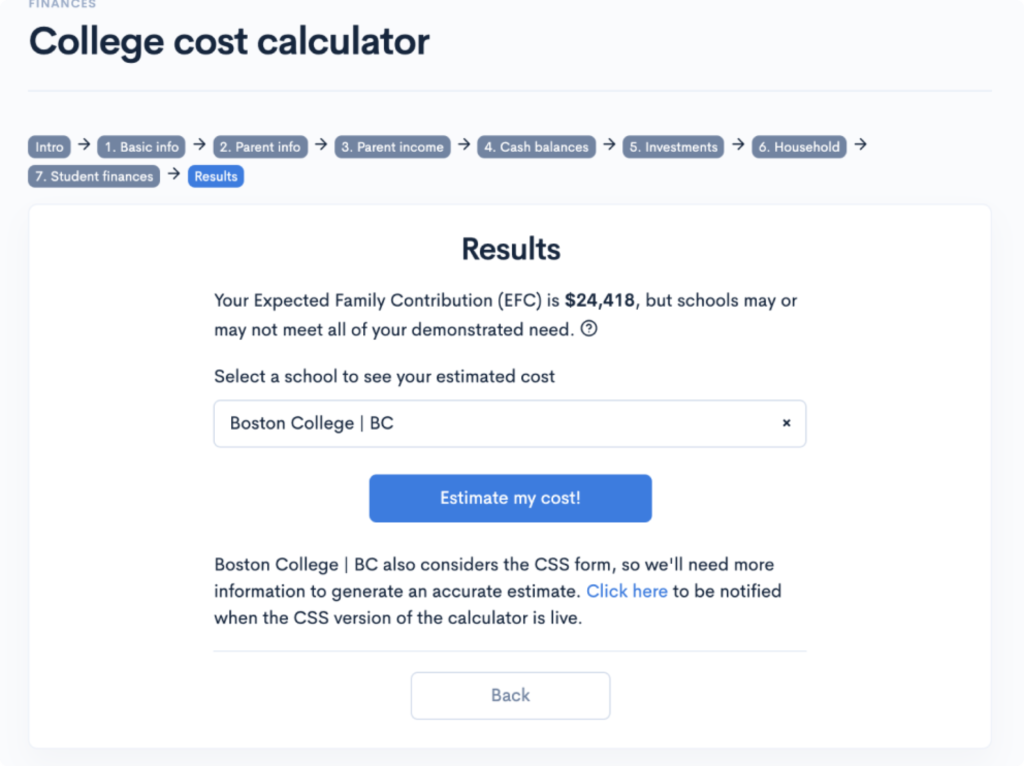

So you’ve gotten your financial aid package back, and it’s a confusing mess of categories and numbers. Or maybe, you’re researching how to finance your college education. Either way, it’s important to make a distinction between the three main forms of financial aid that colleges give: grants, scholarships, and loans. The labels “grant” and “scholarship” are often used interchangeably, but they are different. Grant money is given based on your financial need, and is intended to make paying for college more equitable. On the other hand, scholarships are usually based on achievement, scholastic or otherwise. Scholarships can be given by your college or by any number of other organizations, and it’s a good idea to apply to as many as you can. Grants are considered a form of need-based aid, while scholarships are merit-based. These are both considered “gift aid,” and do not have to be repaid. Loans, however, must be paid back eventually. There are two main categories of student loans: government and private. The federal government will often give the best loans, with flexible repayment plans and better interest rates. The government offers both subsidized and unsubsidized loans. Subsidized loans do not accumulate interest during your time in school, while unsubsidized loans accumulate interest. Your eligibility for federal loans is based on your financial need and Expected Family Contribution (EFC) found through your FAFSA, explained below. There are also various government loan programs run by your state, which can help supplement federal loans. Similar to federal loans, state loans tend to have low interest, fixed rates, and flexible repayment programs. One important factor is that these programs tend to be for state residents attending college in-state, so be sure to check your options and eligibility. Finally, there are private loans, given by organizations like banks, credit unions, or colleges themselves. This is a huge category, with countless options and variants. This should only be an option if your gift aid and government loans aren’t enough. Loans are tricky, so make sure to check out our complete guide to loans and fully understand the terms and implications of any loan you consider. The first step is filing the FAFSA and finding your Expected Family Contribution (EFC). This is what the government thinks your family can pay for college, and it will determine your eligibility for government grants like the Pell Grant. The FAFSA will also give you your Student Aid Report (SAR), which some private need-based scholarships may request. Our Ultimate Guide to the FAFSA will walk you through it: filing is not as scary as it sounds and it’s a good idea to file as soon as it opens on October 1. In addition, the CSS profile is required by some colleges to qualify for institutional grants. The CSS Profile asks for much of the same information as the FAFSA and is used by colleges to get a clearer picture of your finances and determine your eligibility for institutional grants. The deadline for submitting your CSS profile varies by school, so check your school’s admissions website. The College Board, who administers the CSS profile, suggests sending your profile along with your regular application or even a week before. The amount of grant aid you will receive varies greatly, as different colleges cover different percentages of demonstrated financial need and have different financial aid algorithms. There are also colleges that cover 100% of demonstrated need if you get in, and it’s important to look at these schools if you’re expecting to need substantial financial aid. Along with grant aid, most colleges also offer merit scholarships that can be renewable over four years as long as you maintain good academic standing. These can be given based on your GPA, test scores, extracurricular achievements, or other factors. It’s important to note that certain highly ranked schools like those in the Ivy League do not offer merit scholarships, giving only need-based aid. There are dozens of schools with huge merit scholarships that can make an amazing college experience and allow you to walk away from college debt-free. Winners of these scholarships are often given special treatment during all four years of their education, something you can’t get elsewhere. Many institution-based merit scholarships require a separate application and essay, though some schools will consider you automatically if you apply by the priority deadline, which is often in early December. Finally, private scholarships can make a huge impact on your education. There are hundreds of other scholarships out there and thousands of dollars you can earn with some effort. It’s a good idea to start as soon as you can, but you can (and should) apply to these scholarships throughout college. Also ask your school counselor for a list of local scholarships and make sure to apply to these. There are often very few applicants to local scholarships and the prizes are just as big. We at CollegeVine have our own weekly scholarship, where you can win up to $500. The scholarship is free and easy to enter. It only takes a minute to enter! The first step is to file the FAFSA in October to find out your eligibility for government loans, and check out your state’s student aid programs. You will be told about your eligibility for the federal government’s Direct Loans by your college’s financial aid office when you receive your overall financial aid package. Federal Direct Loans do not require an application other than the standard financial aid application with your school using the FAFSA. Once you’ve gotten your package, it’s time to decide with your family if an additional private loan will be necessary. Application processes for private loans vary greatly, so it’s a good idea to talk to someone familiar with your finances or in a similar situation to you. You may already have some relationship with a bank that you can ask for student loans. Some colleges can provide you with a list of preferred lenders. Student loans are a big commitment, so take your time with this part of the process and seek advice if possible. The actual cost of each college can vary significantly for the same family, and you can’t trust the sticker price to tell you your personal cost of attendance. After financial aid, expensive private colleges can actually be cheaper than in-state public schools for some families. Want to estimate your cost of attendance? You can use each individual school’s net price calculator, or check out our free Financial Aid Calculator for an estimate at hundreds of schools in just 3 minutes. Our free Chancing Engine will also tell you your chances of acceptance based on your grades, test scores, extracurriculars, and demographics. Use these free tools to improve your profile and plan for your college finances!

What’s Covered:

What Are Grants and Scholarships?

What Are Loans?

How to Apply for Grants/Scholarships

How to Apply for Loans

How Much Will College Cost Your Family?