A Complete Guide to Need-Based Financial Aid

Paying for college can be daunting, especially with all the current talk about student loan debt. Getting into college is an accomplishment, and everyone deserves the chance to attend. Here are some ways you can help pay for college, so that you can follow your dream. Colleges give out two main types of aid. Need-based aid is given to students who demonstrate financial need, typically from lower- to middle-income households. This type of aid does not take into consideration your academic profile. On the other hand, merit-based aid is awarded to students based on their academic or extracurricular accomplishments. To apply for need-based aid, you have to fill out the FAFSA and/or CSS forms, while merit-based aid has its own applications that differ by school and program. Some schools also automatically award merit aid, with no extra application. These are sums of money from the government that do not have to be repaid. Some examples of federal grants are: The amount that you receive depends on your expected family contribution, cost of tuition at your chosen school, whether you’re a full-time or part-time student, and other factors. Generally, only low-income families are eligible for federal grants. These are grants that are offered by individual schools or other institutions, and are not connected to the federal government. There are state, college, and private grants available. State grants are funded by state governments, and are restricted to students who are residents of that state among other eligibility requirements depending on the specific grant. The amount of aid you can expect ranges anywhere from a few hundred to a few thousand dollars. College grants are offered by the schools themselves. They generally require that you complete a certain amount of credits and meet the minimum GPA requirement. The amount of these grants varies based on your financial need, but some students get significant “discounts” or even full rides. Private grants or outside scholarships can come from any range of companies or organizations. These are usually awarded based on your academic and extracurricular achievements, and many are targeted to special interest groups. Some also consider financial need. We have a whole blog category dedicated to scholarships, where you can find lists of opportunities to save you thousands on college. We at CollegeVine also offer our own $500 scholarship, which will be paid out directly to the student. All you have to do is sign up for a free account and earn karma, the free CollegeVine “currency”. You can earn karma by reviewing essays through our Peer Review tool and answering questions in our Community Forums. After earning that karma, you bid it to enter the scholarship drawing (if you don’t win, that karma will be returned, where you can “spend” it on essay reviews and expert advice). Keep in mind, however, that outside scholarships can reduce your financial need. Many schools may reduce their grants if you win an outside scholarship. Schools generally will first reduce any loans or work-study, but you should double-check before putting lots of effort into private scholarship apps. Student loans are one of the most feared types of financial aid. The difference between grants and loans is that loans must be repaid (with interest). Unfortunately, this is how many young adults accumulate tons of debt. Federal loans include: These options are headed by the US Department of Education, and go through the federal government; the interest rates are fixed, though they are different for each type of loan, and generally serve different purposes. Make sure you pick the right one for your situation. You also don’t have to start repaying federal loans until after you leave college, and the government itself will pay the interest for some loans if you demonstrate need. On the other hand, private loans are provided by private lenders such as SallieMay, CollegeAvenue, and others. These include different interest options as well, but they also come with some potential dangers. Make sure you do research about protections offered by the lender, which is something you don’t have to worry about with federal loans. To learn more about both federal and private loans, check out our post on how to apply for student loans. Keep in mind that there is another type of loan as well: institutional loans. The college itself may offer you a loan as part of your financial aid package. Some schools are no-loan, however, and replace institutional loans with grants when awarding financial aid. These schools tend to offer the most generous financial aid packages. Federal work-study programs ask students to work part-time while they’re enrolled in college. You are directly paid by your school for your work, and you can put this money towards any education-related expenses (like tuition, room and board, etc). These funds don’t have to be repaid, and to be eligible, you have to maintain a certain minimum GPA and complete some number of credits each semester, with specifications varying depending on your school. Jobs can range from being a teaching assistant to being a library desk aide to helping in the dining hall. The best part is that some of these jobs are rather passive and allow you to study while being paid. A relatively new type of aid, ISAs are kind of like a loan, but instead of being in debt, you agree to give your college a certain percentage of your income for a certain number of years after graduation. Some people prefer ISAs to loans, but others find that you end up spending more money, and you also can’t pay off an ISA early like you can a loan. Purdue is perhaps the best-known college that offers ISAs. Just about everyone should apply for financial aid! Even families that earn $150k+ can sometimes get institutional financial aid at private schools. Expensive private schools also offer substantial aid because they don’t want financial difficulties to keep students from being able to attend. For example, Harvard offers a full ride for students with families making under $65,000 per year (generally, these numbers refer to a family of four with typical assets). Families with incomes between $65,000-$150,000 will contribute from 0-10% of their income, and those making more can also receive aid, depending on their situation. Many other schools offer generous financial aid, especially those that promise to meet 100% demonstrated need. Unless you’re 100% comfortable paying full price, it’s definitely worth applying for financial aid. There are a few forms you may need to fill out to apply for need-based financial aid. The FAFSA is administered by the Department of Education and is the main financial aid application. It determines eligibility for federal grants, work-study programs, and federal student loans. Schools also use this information to determine how much additional funding to award you. The FAFSA deadline is June 30th but the earlier you fill it out, the better (the application opens October 1st of the previous year, and many schools have earlier deadlines). How to apply: The CSS Profile is administered by the College Board and it determines eligibility for institutional aid. It’s used by 400+ colleges, usually selective private schools. Ironically enough, you do have to pay to submit the CSS Profile; it costs $25 for the first application, and $16 for each additional application. Fee waivers are available. Deadlines vary by college, but like the FAFSA, the CSS Profile opens on October 1 and most schools want it submitted at the same time you submit your college application. How to apply: The IDOC is administered by the College Board and is usually submitted after you apply for financial aid with the FAFSA and CSS Profile. It allows you to directly submit documentation to schools. Schools must select you to apply for this, and you’ll be notified through your College Board account. How to apply: For more details on each form, check out our Guide to Financial Aid. For merit-based aid, the forms and their details can be found on each college’s website. The answer to this question really depends on the school you choose, how much demonstrated need you have, and any scholarships you’re awarded. There are definitely ways to lower the cost of college, covered above. Our school search tool is useful for narrowing down your choices of schools, while our free chancing engine can help you determine both your chances of getting into many schools and your cost of attendance – we base this off your financial information. We also have data on the return on investment of certain majors at popular schools, helping you make an informed choice. Sign up for your free CollegeVine account to get access to these tools!

What’s Covered:

The Difference between Need-Based and Merit-Based Aid

Different Types of Need-Based Aid

Federal Grants

Institutional Grants

Loans (federal and private)

Work-Study

Income Share Agreements

Who Should Apply for Financial Aid?

How to Apply for Financial Aid

Free Application for Federal Student Aid (FAFSA)

CSS Profile

Institutional Documentation Service (IDOC)

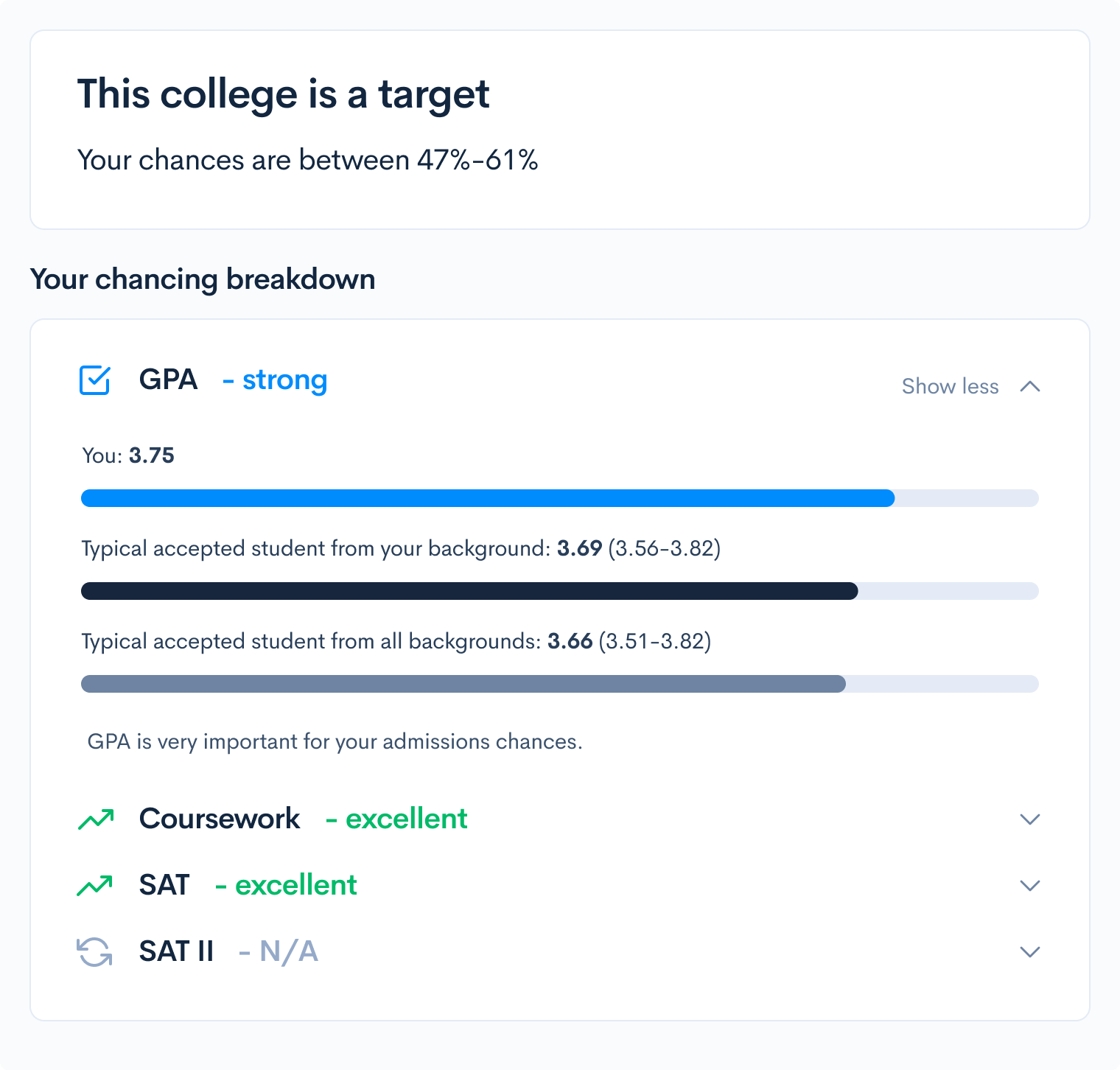

How Much Will College Cost Your Family?