Cheapest and Most Expensive Ivy League Schools

What’s Covered:

- Are Ivy Leagues Expensive?

- Ivy League Schools by Sticker Price

- How Much Will it Cost You to Attend an Ivy?

- Tips for Saving Money on College

The Ivy League often feels unattainable for many students, both in terms of admissions and price. However, you may be surprised to learn that attending an Ivy League school can sometimes be more affordable than attending a public university.

Keep reading to discover which Ivy League schools are the most and least expensive—and how their financial aid policies compare.

Are Ivy Leagues Expensive?

Ivy League schools are often stereotyped as being insanely expensive, and it’s true: as top-ranked private colleges, all have sticker prices near $90,000 once you account for room, board, tuition, and fees. Additionally, Ivies generally don’t offer merit or athletic scholarships.

Luckily, this hefty price isn’t necessarily what all students pay. These schools have large endowments, which enable them to accept students with excellent qualifications regardless of their financial status. Consequently, some students pay less for an Ivy League education than they would at their in-state public university. For some students, it’s even free to attend an Ivy!

Need-Blind

All of the Ivies are need-blind for domestic applicants, meaning that a student’s ability to pay does not factor into their admissions chances. However, for international students, many Ivies are need-aware.

No-Loan

Some schools are no-loan, meaning they provide financial aid without the expectation of repayment. This doesn’t mean that students at no-loan colleges are exempt from taking out loans altogether; they’re expected to pay any funds not covered by financial aid, sometimes through student loans.

100% Demonstrated Need

Students who need financial aid will likely be drawn to universities that meet 100% of demonstrated need. This policy has its action in the title; under it, the university will provide enough aid to cover the difference between your family’s Expected Family Contribution (EFC) and the school’s Cost of Attendance (COA).

Many Ivies have at least two of the aforementioned policies (no-loan, need-blind, and meets 100% need), if not all three.

Ivy League Schools by Sticker Price

|

School |

Location |

Sticker Price |

|

Ithaca, NY |

$96,268* |

|

|

New York, NY |

$92,373 |

|

|

Philadelphia, PA |

$92,288 |

|

|

New Haven, CT |

$91,950 |

|

|

Providence, RI |

$91,676 |

|

|

Hanover, NH |

$91,312 |

|

|

Cambridge, MA |

$89,315 |

|

|

Princeton, NJ |

$86,988 |

*Tuition differs depending on state residency and college/school choice, as some Cornell colleges are public for New York residents.

If you’re like most people, these sums seem intimidating, but don’t worry; the policies we mentioned earlier will likely reduce your financial burden at any of these schools.

Cornell University

Sticker Price: $96,268

Average Net Price: $26,455

Cornell is made up of nine undergraduate colleges and schools, and for in-state students, the cost of tuition may depend on which one they are enrolled in (some colleges at Cornell are state schools!).

Cornell University receives an average financial aid award of $56,464 and 50% of students receive financial aid. Cornell is need-blind for domestic applicants and need-aware for internationals, and it fully meets demonstrated need for all admitted students. Students admitted to Cornell who wish to attend but were offered a stronger financial aid package from Stanford, Duke, MIT, or another Ivy may ask Cornell to match the competing offer.

Cornell is no-loan only for students with a family income of under $75,000 and typical assets.

Columbia University

Sticker Price: $92,373

Average Net Price: $20,869

About half of all Columbia undergrads receive grants from the university and the average award is $76,265. Columbia has consistently been among the Ivies with the highest proportion of undergrads receiving Pell Grants—24% of its most recent incoming class.

Students from families with annual incomes below $150,000 and typical assets can attend Columbia tuition-free. Those from families earning less than $66,000 are not expected to contribute to the cost of attendance at all.

Columbia practices need-blind admissions for domestic students and is need-aware for international students. It will meet 100% of the demonstrated needs of all admitted students.

First-year international applicants must indicate their intention to apply for aid at the time of their admission application. If not, they will not be able to change their aid application status, even if their financial circumstances change. If aid is not awarded to an international student at the time of admission, it will not be awarded in the following years.

Columbia is no-loan, with aid provided in the form of grants and student work.

University of Pennsylvania | UPenn

Sticker Price: $92,288

Average Net Price: $26,017

In the 2023-24 academic year, the University of Pennsylvania awarded an average financial aid package of $66,222 and 46% of students received need-based financial aid. The University of Pennsylvania meets 100% of all students’ demonstrated financial need for all four years via grants and work-study funding. UPenn’s goal is for students to graduate debt-free, so the school is no-loan as well.

At UPenn, families earning up to $200,000 with typical assets can expect financial aid packages that cover at least full tuition, and often more. For those earning under $75,000, aid covers all billed expenses—including tuition, housing, and dining—plus additional resources to ensure equal access to campus opportunities.

UPenn practices need-blind admissions for students from the U.S., Canada, or Mexico, and need-aware admissions for the rest. International students not admitted with financial aid in their first year may not apply for it in any subsequent years. However, international students who do receive aid have 100% of their demonstrated need met, just like domestic undergrads. Since international students are not eligible for federal funding, all of their aid comes directly from the institution; consequently, they may have to pay taxes on any funding they receive from UPenn.

Yale University

Sticker Price: $91,950

Average Net Price: $26,044

The average scholarship offered by Yale in 2024-25 was almost $73,000 and 55% of students received financial aid.

Yale practices need-blind admissions for all applicants and meets 100% of demonstrated need for all admitted students. Yale is no-loan—it awards aid in the form of grants and scholarships, which do not require repayment.

Yale students from families with below $75,000 and typical assets qualify for “zero parent share,” the university’s most generous offer—it covers the full cost of tuition, fees, housing, food, and travel.

Brown University

Sticker Price: $91,676

Average Net Price: $26,608

Brown awarded need-based financial aid to 49% of the Class of 2029, with the average family contribution totaling $32,160. The university practices need-blind admissions for first-year domestic and international applicants and meets 100% of their demonstrated financial need.

Brown is also no-loan. Financial aid is given in the form of scholarships and grants—which don’t have to be repaid—as well as work-study.

Dartmouth College

Sticker Price: $91,312

Average Net Price: $17,322

Dartmouth aid recipients received $59,611 in grants and scholarships in the 2022-23 academic year and 49% of Dartmouth students received financial aid in the form of grants and scholarships.

Dartmouth is need-blind for all applicants—domestic and international—and meets 100% of demonstrated financial need for every student. Dartmouth is no-loan and zero parent contribution for students from families with an annual income of $125,000 or less and typical assets. Students with families making more than $125,000 often receive aid as well—there is no income cutoff for scholarship consideration at the college.

Dartmouth’s financial aid policies, tuition, and family EFC is the same for a study-abroad semester as it is for an on-campus one, and the school often helps fund unpaid internships and research.

Harvard University

Sticker Price: $89,315

Average Net Price: $17,900

Rather boldly, the school claims, “Yes—you can afford Harvard” on their financial aid website, promising that finances will not keep a student from attending. More than half (55%) of students receive financial aid and the average family contribution is $13,000. A quarter of Harvard families pay nothing!

For students with family incomes of less than $100,000, financial aid includes all billed expenses, including health insurance (if needed), travel costs, winter gear, and events. Students from families with $200,000 annual incomes and typical assets pay no tuition and often qualify for aid to cover other costs.

Harvard is need-blind for all applicants and meets the full demonstrated need of all admitted students regardless of citizenship status or country of origin. All financial packages are designed without loans.

In addition to tuition aid, Harvard offers millions of dollars in student funding for community service, research, learning, international travel, and career opportunities.

Princeton University

Sticker Price: $86,988

Average Net Price: $19,811

Princeton is commonly regarded as the “cheapest Ivy,” thanks to its extensive financial aid offerings—69% of the Class of 2029 qualified for financial aid, and the average grant covers 100% of tuition.

Princeton is need-blind for all applicants and will meet 100% of their demonstrated need. Princeton is no-loan and a whopping 90% of recent seniors graduated debt-free. Most undergraduates from families with incomes up to $150,000 will pay nothing to attend Princeton, while those from families with incomes up to $250,000 will pay no tuition.

Roughly a quarter of Princeton’s Class of 2029 is Pell-Grant eligible.

How Much Will it Cost You to Attend an Ivy?

Many students won’t pay the full sticker price, and the listed average net price isn’t usually what you’ll pay, either; it’s just intended to give you an idea of the aid offered. The Office of Financial Aid at every college will review your application on an individual, case-by-case basis, taking the various unique elements of your financial circumstances into account.

Each school covered here has a net price calculator to give you a more realistic sense of what you will actually have to pay, which may be much higher or lower than the listed averages. The calculators can’t predict your cost with 100% accuracy, but they should give you a solid idea of what to expect.

If you’re on the hunt for more affordable schools to round out your list, check out our school search tool. Our detailed algorithm lets you filter through hundreds of colleges using dozens of factors, including cost.

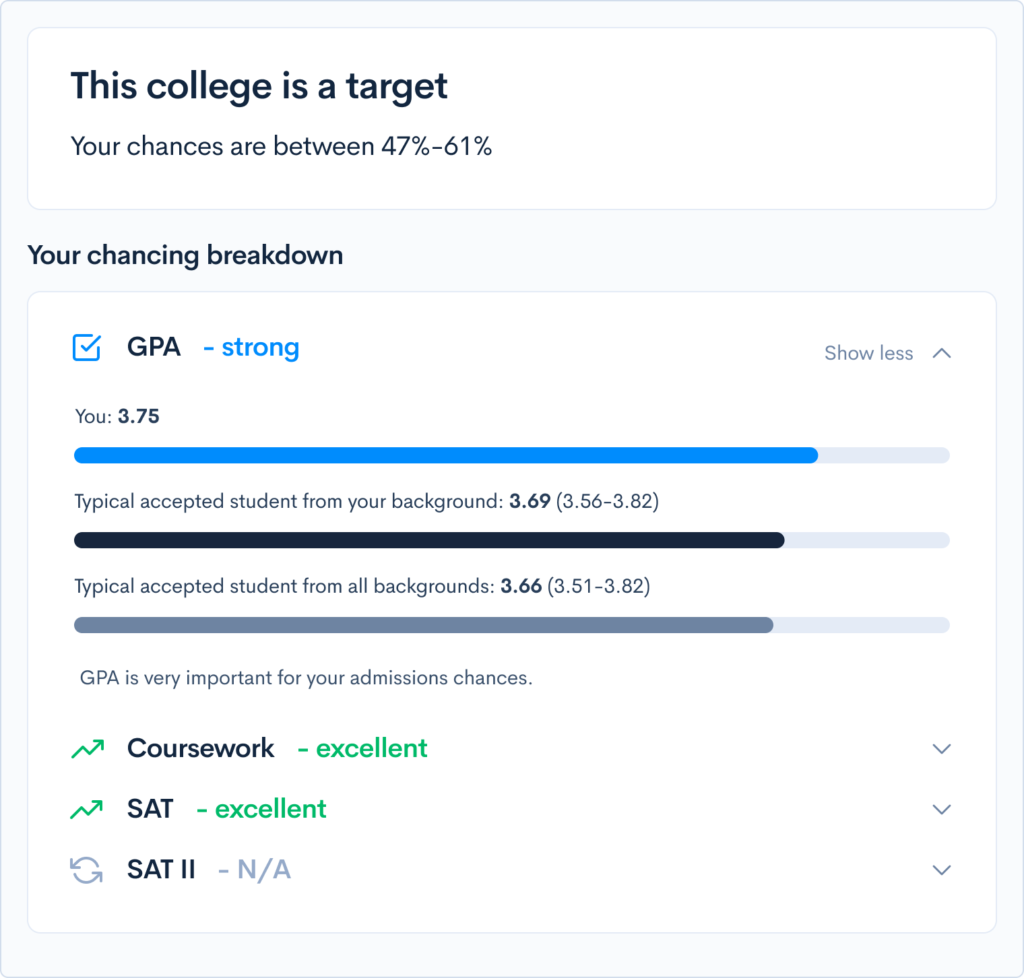

If you’re unsure of your actual chances at any of these schools, try our free Chancing Engine! It will help you predict your odds, understand how you stack up against other applicants, and suggest parts of your profile to improve. Unlike other solely stats-based chancing calculators, ours considers your profile holistically, considering your quantitative stats, qualitative extracurriculars, and demographic background.

Tips for Saving Money in College

College is more expensive now than ever, but that doesn’t mean you have to be saddled with crushing student loan debt! You may alleviate some of your future stresses through some of our following tips:

1. Apply to schools with fantastic financial aid offerings.

The aforementioned Ivies, as well as most Top 20 universities and liberal arts colleges, tend to have endowments allowing for a world-class education at an affordable price.

2. Don’t discount safeties!

Many of them may be more affordable for you than a “top” private school, and since you’ll be in the upper 75% of their applicant pool, you’ll be especially eligible for any merit-based scholarships.

Attending a safety school for your undergraduate years is an especially smart move for students who ultimately aim to attend grad school. Scholarships and honors programs can keep students academically challenged and financially stable before they shoot for top graduate programs.

3. Focus on institutionally funded scholarships over external ones.

As explained in our “Secret to Winning Merit Scholarships” blog post, many great schools allocate significant scholarship funds to already-admitted students. The exception to this “rule” lies in the case of the National Merit Scholarship Program, which automatically gives high PSAT scorers a shot at high academic recognition and substantial scholarship wins.

4. Check out local scholarships!

Nationwide ones are great, but it’s exceedingly difficult to beat out tens of thousands of other similarly qualified students. By contrast, local scholarships can garner substantial wins, especially because you’ll only be competing against other kids in your hometown.

5. Look into Questbridge if you’re a low-income high-achiever.

The Questbridge program “matches” qualifying students with one of more than 40 prestigious U.S. colleges and universities—including all eight Ivies—where they can receive a four-year undergraduate degree for free.

6. Be open to work-study programs and opportunities if you have any demonstrated financial need.

We touched on them earlier in this post, and they really are great ways to lessen your financial burden. Eligible students work part-time jobs to supplement their educational expenses, often learning valuable skills in the process. The jobs are typically civic and service-oriented or somehow related to your intended career path.