How to Receive A Common App Fee Waiver

The college application process can be a very costly endeavor. If you’re a college applicant who is working with a tight budget, you probably already know this all too well. Before you even get to the question of how you’ll pay your tuition, you’ll incur costs for standardized test registration, test score reporting to colleges, filling out the CSS profile to apply for financial aid, and perhaps extracurricular activities, tutoring, or campus visits.

Then, of course, there are the fees you must pay when you submit your applications. If you’re applying to a range of safety, target, and reach schools, as you’re generally advised to do, the costs can really start to add up, especially if you’re an applicant from a low-income family. It’s frustrating to think that circumstances beyond your control may restrict you from even applying to the colleges you’ve fallen in love with.

However, no college wants to see potential applicants excluded from attending — or even applying — because of their financial need. There are a number of programs available to help applicants and their families for whom college application costs pose a major burden. One of these programs is the Common Application’s fee waiver program, which offers to waive the cost of applying through the Common App for students who can demonstrate that they and their families need financial assistance.

In this post, we’ll go over the process of requesting, obtaining, and using an application fee waiver through the Common App. If you’re eligible for the Common App fee waiver program, it can be a great tool for expanding your college horizons and making the financially stressful college application process a little easier on your family.

Looking for the latest advice on the Common App essays? Check out the CollegeVine blog post How to Write the Common Application Essays 2017-2018.

What is a Common App fee waiver?

Application fees are a standard part of the college application process, and are set by individual colleges. In the past, applicants would typically need to send a check for the application fee along with each paper application. Nowadays, online applications have for the most part supplanted paper applications, and that check has for the most part been replaced with an online payment system.

Typically, paying your application fee is one of the last steps before hitting “submit” on your online application. You’re required to pay the application fee before the college in question will consider your application.

The actual amounts of application fees have changed over time and vary greatly from school to school, even among schools that use the Common App system. As of the 2016-2017 school year, application fees for Common App schools generally range from about $25 to about $90 per school, or higher for some international applicants.

While application fees help colleges cover the cost of processing and evaluating all those applications, institutions do recognize that these fees are more manageable for some people than for others. For some applicants and their families, paying the full price to apply to a range of schools, on top of all the other costs involved in the college application process, would represent a considerable hardship.

Therefore, a number of different programs have arisen to assist applicants with financial need for whom application fees would be a serious burden. If you receive what is generally known as an application fee waiver from one of these programs, you will not be required to submit payment in order for the school to consider your application.

Many students today apply to college through the Common App, which helps streamline the application process for applicants to its almost 700 member colleges. The Common App has developed its own process through which students can seek fee waivers for colleges which use the Common App.

If you are eligible for, request, and receive a Common App fee waiver, you will not be charged an application fee by any of the colleges you apply to through the Common App system. As you can imagine, this can represent considerable savings for your family.

Who can get a fee waiver for the Common App?

Common App fee waivers are intended for college applicants whose financial circumstances would pose a major barrier to applying to college. In order to receive a waiver, you’ll need to be able to show that you need it.

According to the Common App website, you can demonstrate your financial need by meeting at least one of the following conditions.

- “You have received or are eligible to receive an ACT or SAT testing fee waiver.” SAT and ACT fee waivers are requested through your guidance counselor. You can check the SAT website or the ACT website for more information about who is eligible for those waivers.

- “You are enrolled in or eligible to participate in the Federal Free or Reduced Price Lunch (FRPL) program.” Families apply to the FRPL program through their individual schools, and your school should be able to help you determine whether you are eligible.

- “Your annual family income falls within the Income Eligibility Guidelines set by the USDA Food and Nutrition Service.” The Income Eligibility Guidelines help determine who is eligible for the FRPL program. These guidelines change from year to year, and your school should be able to help you determine whether you fall within them. A chart of the guidelines is also included within this PDF provided by the U.S. Department of Agriculture.

- “You are enrolled in a federal, state, or local program that aids students from low-income families (e.g., TRIO programs such as Upward Bound).” If you’re not sure whether a program in which you are involved qualifies, the program’s website or the administrators of that program should be able to help you figure it out.

- “Your family receives public assistance.” This could cover a number of different federal, state, and other assistance programs. If you’re not sure whether your family falls within this category, ask a parent or family member.

- “You live in federally subsidized public housing, a foster home or are homeless.” If you’re not sure whether you live in federally subsidized public housing, ask a parent or family member. If you’re not sure how to categorize your housing situation, this overview of the official definitions of the word “homeless” may be helpful to you.

- “You are a ward of the state or an orphan.” The exact definitions of the terms “ward of the state” and “orphan” vary by state and legal context, but if you fall into this category, you’re probably already aware of it. If you’re not sure, a family member, legal guardian, foster parent, or others may be able to provide more information — it really depends on your situation.

- “You can provide a supporting statement from a school official, college access counselor, financial aid officer, or community leader.” We’ll go over what this actually means in greater detail below.

If one or more of these statements applies to you, you qualify to have your Common App fees waived. You’ll formally request that waiver during the process of filling out the Common App, as we’ll describe in the next section of this post.

When your application is processed, your guidance counselor will be asked to confirm your eligibility for a fee waiver. You’ll probably want to speak with your counselor ahead of time to make sure they understand your financial situation and are prepared to support your request.

What if your situation is such that you need financial help to afford to apply to college, but for reasons that don’t fit neatly into one of the above categories? For instance, perhaps your parent recently lost their job, or a member of your family recently incurred a major, unexpected medical expense. It’s also possible that your family’s financial situation looks better on paper than it really is.

You may still be eligible for a Common App fee waiver under these circumstances. According to the Common App, as we mentioned above, you must be able to “provide a supporting statement from a school official, college access counselor, financial aid officer, or community leader.”

If you believe you fall into this category, speak to your guidance counselor or equivalent school official. If they are asked to give a statement in support of your fee waiver request, you’ll want to make sure that the two of you are on the same page about your financial situation.

If I’m eligible, how do I request and receive a Common App fee waiver?

If your financial circumstances merit the Common App waiving your application fees, you’ll need to formally request a waiver when you fill out the Common App. Here’s a brief overview of how to go about that.

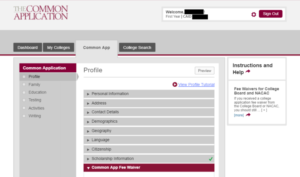

When you log into your Common App account, you will first be directed to your Dashboard. Clicking on the tab that says “Common App” will bring you to your actual application. In order to access the fee waiver request form, click on “Profile” in the left-hand column. It will look like the screenshot below:

The “Profile” page covers all the basic facts about you, from your name and birthdate to what language you speak and other demographic information. Last on the list is “Common App Fee Waiver.” Click on that, and the form will open up to show the questions you see in the screenshot below.

First, the application will ask you whether you wish to request a fee waiver. Specifically, it will ask, “Our member colleges want to make sure that application fees do not pose a barrier for any student who wishes to apply for admission. Do you feel that your financial circumstances might qualify you for an application fee waiver?” Click “yes” to answer this question.

Next, you’ll be asked to check off the reason(s) why you are eligible for a waiver from the list of eligibility conditions we mentioned earlier in this post. Check all the boxes that apply to your situation. You’ll then be asked to type your name as a signature to certify that you “understand and meet the eligibility requirements” and know that your counselor may be required to submit a supporting statement on your behalf.

Last, the Common App will ask you if you would like to receive information from Strive For College, a nonprofit organization that offers advising and mentoring to high school juniors and seniors. It’s up to you whether to click “yes” or “no” for this option, and it will not affect your application either way. If you’re a transfer applicant rather than a first-year applicant, you can also click on the provided link for more transfer-specific application information and assistance.

After this point, the Common App fee waiver request is out of your hands. As we mentioned earlier in this post, your guidance counselor will be asked by the Common App directly to confirm that you are eligible for a fee waiver under this program. In some cases, the counselor may be asked to submit a more detailed statement explaining why you need financial assistance.

And that’s it! The process for requesting a Common App fee waiver is really quite simple. Unlike the more involved process of applying for financial aid, requesting a fee waiver will not in itself require you to provide any more specific financial information about yourself or your family. (You may have been required to provide additional information in order to participate in one of the programs that make you eligible for the Common App fee waiver, such as the FRPL program.)

Your Common App fee waiver will be automatically applied when you submit each application through the Common App system. Normally, at that point, an applicant would be redirected from the Common App website to the college’s individual website to pay their application fee. However, in your case, the Common App fee waiver will cover your application fee.

One final note: The Common App fee waiver request form generally operates on the honor system, and it’s rare for the Common App to deny fee waiver requests. As long as your guidance counselor is able to confirm that you need financial assistance and submit an additional statement if requested, you shouldn’t have a problem receiving your fee waiver.

There’s no getting around it — applying to college on a tight budget is tough. However, most schools and other institutions understand what a barrier these costs can be, and their awareness of this issue has led to the development of programs such as the Common App fee waiver program.

Remember, the Common App fee waiver only applies to your application fee, and cannot be used to cover other costs involved in the college application process, such as standardized test registration fees or score reporting fees. (Separate financial assistance programs may be available to cover these costs; speak to your guidance counselor for more information.) Also, the Common App fee waiver only counts for colleges to which you’ll be applying through the Common App.

If one or more of your chosen colleges do not use the Common App system, you may still be able to have your application fee waived. The particular school’s application or website should be able to tell you if waivers are available at that school and, if so, how to apply for one.

In addition, there are other programs which might be able to provide fee waivers for your college applications not covered by the Common App fee waiver. These include fee waiver programs operated by the College Board and by the National Association of College Advisors and Counselors.

Check with your guidance counselor for more information about whether you’re eligible for these programs, how to apply, and whether your chosen colleges participate in these fee waiver programs. However, regardless of whether you use these other fee waiver programs, if you also meet the eligibility guidelines for the Common App fee waiver process, you should definitely request a fee waiver when you fill out the Common App.

Don’t let your family’s financial situation discourage you from even applying to college. You do have options to make the application process more affordable, though you may have to do a little more research and paperwork to find them. The most important thing to remember is to stay engaged, up-to-date, and informed on how to take advantage of the opportunities that are available to you.

Are you concerned about the financial side of the college application process? CollegeVine can help! We’re here with more information about how to apply for financial aid during the college admissions process, how to seek out and apply for scholarships, and how to consider and compare your financial aid award offers.

Still have questions about filling out the Common Application? Check out our blog post How to Write the Common Application Essays 2019-2020.

Want help with your college essays to improve your admissions chances? Sign up for your free CollegeVine account and get access to our essay guides and courses. You can also get your essay peer-reviewed and improve your own writing skills by reviewing other students’ essays.