How Much Financial Aid Can you Get?

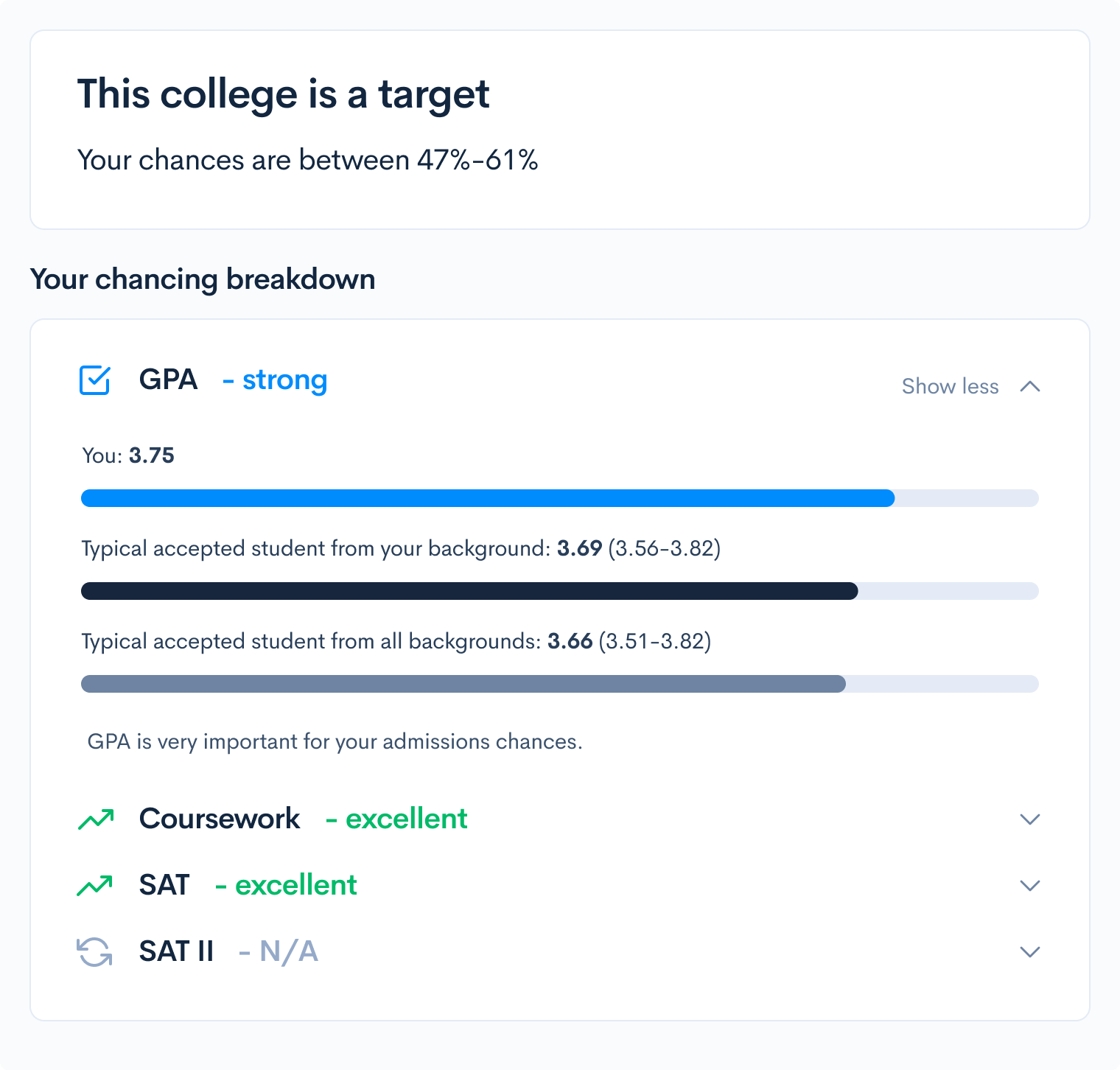

With the rising tuition costs, being able to afford college may be at the forefront of your mind. Fortunately, there are many options available to finance college. In this post, we’ll discuss types of financial aid, and how much financial aid it is possible to receive each semester. Financial aid is any sort of outside funding that helps you pay for college, and it comes in many forms. Grants: Money that does not need to be repaid to the issuer. Grants are based on financial need, so award amounts vary. Federal and state governments offer grants, and the colleges themselves do as well. Scholarships: Like grants, scholarships don’t need to be repaid, though they are based on merit/achievements rather than need (some may take need into consideration). The terms “grants” and “scholarships” are often used interchangeably in college financial aid, though they do mean different things. Loans: Money that needs to be repaid with interest. These loans may be federal or provided by your institution. Private loans are also available, although they are typically more expensive than public loans, but they can help if you need more funds than federal loans provide. Work-Study programs: Provides on-campus part-time paid jobs for students to pay for their education. These types of programs are organized by your school, and you will earn at least minimum wage. The amount of federal aid you receive depends on your need. Below is a breakdown of the average and maximum amounts you can receive. These are rounded to the nearest $10. Type of Aid Average Amount Maximum Amount Federal Pell Grant $4,310 $6,345 Federal Direct Stafford Loan $5,800 (dependent) $7,630 (independent) $5,500-$7,500 (dependent) $9,500-$12,500 (independent) Federal Work Study $2,340 No maximum $4,000 (90th percentile) Federal Supplemental Educational Opportunity Grant $670 $4,000 Total Federal Student Aid $13,120 (dependent) $14,950 (independent) $19,845 to $21,845 (dependent) $23,845 too $32,345 (independent) Total Federal Grants $4,980 $10,345 If you want to get a more accurate estimate of how much federal aid you might receive, use the FAFSA4Caster. The amount of aid you can receive from your school really depends on the school itself and your financial situation. Typically, more expensive, private schools offer more aid since the cost of attendance tends to be higher. If you are lower- to middle-income, you’re more likely to receive significant aid packages. Some families even pay nothing to attend college, after government and institutional aid! Upper middle class families also sometimes qualify for aid. For example, Harvard offers full rides for students with families making under $65,000 per year. Families with incomes between $65,000 and $150,000 will contribute from 0-10% of their income. If you want to estimate how much aid you may receive from a specific school, you can use each school’s net price calculator or input your information on CollegeVine’s free college cost calculator to see your expected contribution at hundreds of schools. As you apply for financial aid, there are two online forms that you should be aware of. The first is the FAFSA (Free Application for Federal Student Aid), and the second is the CSS Profile (College Scholarship Service). The FAFSA is a free application to determine if you qualify for federal financial aid. Specifically, this application checks if you could be eligible for Pell Grants, work-study, or other federal loans. Colleges also use the FAFSA to determine institutional aid. The FAFSA opens at the end of October each year, and most schools ask that you submit it at the same time as your application. 1. Create a FSA ID & Log In The FSA ID is a username and password combination that will be used for you to log into your account, and it is also used as your legally binding signature. Your parents must also create an FSA and ID. You can register on the Federal Student Aid website. When you log in, you’ll have the chance to create a “save key” as well, which allows you to go back to the form if you don’t want to complete it in one sitting. Then, fill out the basic identifying information such as name, date of birth, social security number, and drivers license or Alien Registration Number. You’ll then fill out background information questions. 2. Collect All Financial Information You Need You will need different pieces of information about you and your family’s financial situation, so it is a good idea to collect information as early as possible. If you’ve ever worked, you’ll need your own tax documents, W-2 forms, and information on your savings and investments. If you are considered a dependent (most students are), you will also need income and tax information for your parents. You’ll need all this information from the last 2 years. 3. Fill Out Financial Information Next, it is time to fill out all the financial information that is required. Keep in mind that you will need to include tax information. You may be able to use the IRS Data Retrieval Tool which will automatically import all your tax information from the IRS. If you cannot use the IRS DRT, you will have to manually enter all your information. 4. Send Your Application and Submit On the application, you’ll need to specify which colleges receive your FAFSA. After this, sign and submit your application. You’ll then get a confirmation email that your application has been received. In comparison, the CSS is only used by certain schools (usually selective private colleges), and it determines eligibility for institutional aid. The CSS is administered by the College Board, and you must pay to apply, though there are fee waivers. This application looks deeper into your family’s finances than the FAFSA. The deadline for the CSS profile is between January 1 and March 31—it depends on what schools you are applying to and their specific deadlines. 1. Sign In to College Board Since the CSS is managed by College Board, so if you have a College Board account you can use your existing login credentials. If not, create a new account. 2. Fill out Background Information In the first section, you’ll need to fill out basic information about yourself. This includes your name, date of birth, nationality, phone number, marital status, and social security number. You’ll also need your parents to fill out their social security numbers, background information, and employment status. 3. Collect Relevant Financial Information To fill out the CSS profile, you’ll need your parent’s financial information, including income and assets, tax returns, W-2 forms, and bank statements. 4. Submit Your Application to Schools Similar to the FAFSA, you must individually submit your application to the universities you are applying to. The cost to submit your initial application to one school is $25, and each additional school is $16. You may qualify for a fee waiver. As you create your school list and apply for college, it is important to understand the cost of attendance and your chances of acceptance. Check out our free chancing calculator to find the best-fit school for you. The calculator can help you determine whether you can afford a particular college, how it fits your needs, estimate your chances of being accepted. Best of all, the calculator is completely free! What’s Covered:

Types of Financial Aid

How Much Federal Aid Can I Receive?

How Much Institutional Aid Can I Receive?

How to Apply for Financial Aid

Applying for Aid Using the FAFSA

Applying for aid using the CSS Profile