Do You Have to Pay Back Pell Grants? Situations Where You Do

What’s Covered:

- What Is a Pell Grant?

- Do You Have to Pay Back Pell Grants?

- How to Get a Pell Grant

- Other Forms of College Funding

- How Much Will College Cost Your Family?

Before enrolling in a college or university, it’s critical to have a plan in place to pay for your college tuition. Although student loans are always an option, borrowing money may require you to carry debt for years after you’ve earned your degree.

Fortunately, there are dozens of scholarships and grants you can apply for to lower the cost of your college tuition. Since grants and scholarships are free money, they are the best financing options to reduce or eliminate student loans.

The Federal Pell Grant is a popular need-based grant from the government. Although grants typically never need to be reimbursed, there are a few instances where you may have to pay back a Pell Grant. Here’s a look at everything you need to know about applying for, earning, and paying back a Pell Grant.

What Is a Pell Grant?

Pell Grants are federal grants awarded to undergraduate students with significant financial need. The amount you can earn from a Pell Grant varies according to:

- Your family’s expected financial contribution

- The cost of tuition at your college or university

- Your enrollment status as a full-time or part-time student

- The number of years you plan to attend school

To maintain your Pell Grant, you must stay enrolled in an undergraduate program at a qualifying school and fill out the FAFSA form each year. You are no longer eligible for the Pell Grant once you’re graduated with your bachelor’s degree or have spent twelve semesters in school.

Do You Have to Pay Back Pell Grants?

Typically, Federal Pell Grants, and all other grants, don’t need to be repaid. However, if you find yourself in one of the following situations, you may be asked to pay back a portion or all of your Pell Grant:

- You withdrew from the program for which the grant was given to you

- Your enrollment status changed your eligibility for the grant

- You received outside scholarships, grants, or other financial aid that reduced your need for federal assistance

If you need to repay part of your grant, your school will notify you, and you will have 45 days to either repay the funding or arrange repayment.

Ultimately, to avoid paying back your Pell Grant, you will need to graduate with your bachelor’s degree from a qualifying college or university within six years.

How to Get a Pell Grant

You have to submit a Free Application for Federal Student Aid (FAFSA) form to receive a Pell Grant. Once you’ve been approved for a Pell Grant, you will need to complete and submit the FAFSA every year to remain eligible for financial aid.

Aside from filling out the FAFSA, students need to meet the following criteria to be eligible for a Pell Grant:

- You are a U.S. citizen or eligible noncitizen with a Social Security number

- You must register for the Selective Service (only male students)

- You must already be accepted for enrollment or plan to enroll in a school

- You must show financial need

- You must have a high school diploma (or equivalent)

- You must maintain a specific GPA during your time in college

- You must maintain full-time enrollment

Students who are not eligible for Pell Grants include people currently in prison or subject to a civil commitment following imprisonment for a sexual offense.

Other Forms of College Funding

Pell Grants aren’t the only funding option for college. Here are some other scholarship and grant options to explore when creating a financial plan for your degree.

Federal Grants

Aside from Federal Pell Grants, students can also apply to the Federal TEACH Grant and Federal Supplemental Educational Opportunity Grant (FSEOG).

The Federal TEACH Grant is created for education majors and future teachers who want to lower the cost of their education. To become eligible for the Federal TEACH Grant, students must commit to teaching a high-need subject in a low-income community for at least four years after graduation.

The FSEOG is designed to supplement Pell Grants for students who have the most need for financial assistance. While Pell Grants are awarded from the government, the FSEOG is given to students from schools. The FSEOG is federally funded, but participating schools also contribute 25% to the award totals. Only students who receive a Pell Grant are eligible to receive the FSEOG.

State Grants

In addition to federal grants, students can apply for state grants for college. Most state grants require you to fill out the FAFSA form and are usually restricted to residents who are attending in-state schools.

For example, students from California can apply for the Cal Grant Programs to attend the University of California, California State University, California Community College, or other qualifying independent and career colleges in California. Students in Massachusetts can apply for various grants, including the MASSGrant for need-based assistance and a Cash Grant to cover additional educational expenses. Research which state grants are available where you live to determine which option is best for you!

Institutional Grants

Institutional grants and scholarships are often the best ways to secure financial aid since schools have a large amount of money to distribute amongst students.

Certain schools help to offset the cost of college based on demonstrated financial need. Demonstrated financial need is determined by subtracting the expected family contribution (EFC) from the total cost of attending a college (COA), including room, board, and tuition.

Many schools agree to meet 100% of a student’s demonstrated financial need without loans. Some schools require families to fall within certain income thresholds to qualify, and others include loans in their financial aid packages. Read this blog to find schools committed to meeting 100% of their students’ demonstrated financial needs.

Many students who don’t qualify for Pell Grants and other need-based grants are eligible for merit-based scholarships. Merit aid is offered to students based on their achievements and qualifications and considers test scores, GPA, and class rank. If you’re searching for merit-based scholarships, these 50 colleges and universities offer the most merit aid to students who don’t qualify for federal assistance.

Outside Scholarships

Finally, you can also earn funding for schooling from outside scholarships awarded by entities other than the federal government, state government, or colleges and universities.

For example, high school students from low-income families can utilize QuestBridge’s National College Match Program to earn a full-ride scholarship to over 40 of the most prestigious schools in the United States, including Vanderbilt University, Yale University, and Stanford University.

You can also explore CollegeVine’s library of articles to find unique scholarships that apply to your demographics, location, skills, degree, interests, and more!

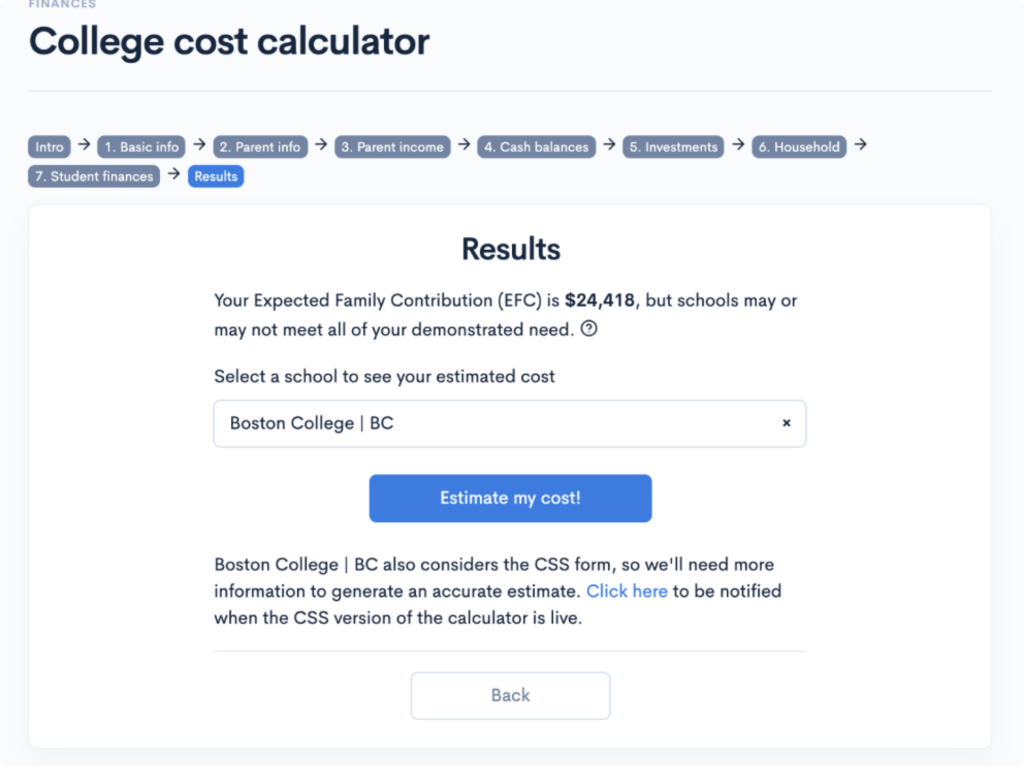

How Much Will College Cost Your Family?

Even though college tuition can be expensive, need-based grants and other scholarships can put the cost of college within reach—without student loans!

Often, the price to obtain a bachelor’s degree at an expensive private college is cheaper than attending an in-state public school if you take advantage of federal grants, like a Pell Grant, as well as institutional grants and outside scholarships.

If you’re curious how much college will cost your family, utilize our free chancing engine and cost calculator. These tools will help you determine your college admission chances and determine how much college will cost after receiving need-based aid and merit scholarships.