Economics BA vs. BS: Which is Right for You?

What’s Covered:

- Similarities Between the Economics B.A. and B.S.

- Differences Between the Economics B.A. and B.S.

- Best Schools for Economics Majors

- Economics Major Career Paths

So you already know that you want to major in Economics–congratulations! You may have had to make some difficult decisions to determine your ideal major, but you’ve made the choice!

One thing you may not know about the economics majors is that they are sometimes considered Bachelor of Arts (B.A.) degrees and sometimes Bachelor of Science (B.S.) degrees. While this may initially seem like the same thing, these programs can be quite different.

In this post, we’ll discuss the similarities and differences between B.A. and B.S. economics programs, as well as the best schools and career paths for economics majors.

Similarities Between the Economics B.A. and B.S.

Generally, employers and master’s degree programs will view a B.A. or B.S. in economics very similarly. After all, both degrees are similar in content, and the degree length is typically the same. Here are the main similarities between both degrees.

Coursework and Requirements

Both a B.A. and B.S. in economics will teach you the foundations of micro and macroeconomics, and you will have to take classes on economic theory and calculus. Both degrees give you the analytical skills and knowledge on theory that is essential to understanding economics.

Degree Length

The degree length for these programs is typically the same, although some B.S. programs may require that you take more credit hours in STEM-heavy classes.

Salaries and Career Options

Either a B.A. or B.S. in economics will open doors to a variety of career opportunities or continuing education in a master’s or PhD program. Most students in economics programs do go on to employment without an advanced degree. For jobs in market research, compliance, sales, operations, and consulting, both B.S. and B.A. candidates would be eligible for these jobs.

Differences Between the Economics B.A. and B.S.

It is important to realize that not all schools offer both B.A. and B.S. options for economics majors. Liberal arts colleges, for example, typically only offer the B.A. degree, while larger colleges often have both options. Here are the key differences between both degrees.

Coursework and Requirements

Typically, the B.S. degree requires 2 or 3 classes in calculus, as opposed to just 1 required by the B.A. degree. If you are more interested in the theory behind economics and its practical application, you should consider the B.A. degree since it offers more opportunities to take theory-based economic classes. If you are interested in the math behind economic decisions, the B.S. degree is a better choice for you.

Salaries and Career Options

If you are seeking employment in a field such as quantitative finance, the skills and analytical methods you learn in a B.S. degree program will be more helpful than that of a B.A. Additionally, pursuing the B.S. will show employers that you have the analytical skills you need to pursue a more technically demanding role. For any other role or career, however, both the B.S. and B.A. will provide a solid foundation in economics needed to succeed.

If you are looking to pursue an advanced degree, it is recommended that you pursue a B.S. degree. This is because the B.S. typically requires more quantitative coursework which is also required in Master’s and PhD programs.

The University of Washington is one school that offers both a B.S. and a B.A. option in economics. Below is the required coursework for each major. As you can see, the B.S. option requires 2 more math classes.

|

B.A. in Economics |

B.S. in Economics |

|

Prerequisites: |

Prerequisites: |

|

Intro to Macroeconomics |

Intro to Macroeconomics |

|

Intro to Microeconomics |

Intro to Microeconomics |

|

English Composition |

English Composition |

|

Elements of Statistical Methods |

Elements of Statistical Methods |

|

Calculus with Analytic Geometry |

Calculus with Analytic Geometry I |

|

N/A |

Calculus with Analytic Geometry II |

|

N/A |

Calculus with Analytic Geometry III |

|

Intermediate Microeconomics |

Intermediate Microeconomics |

|

Intermediate Macroeconomics |

Intermediate Macroeconomics |

|

Introduction to Econometrics |

Theory and Methods |

|

5 elective courses |

3 elective courses |

Generally, the degree you receive will not matter much unless you wish to go into a quantitative field where you need the skills in math, or if you wish to pursue a Master’s or PhD in economics. For other careers, either option will teach you the foundational economic concepts you need to know.

Best Schools for Economics Majors

Below is a list of some of the best schools for economics majors and whether they offer a B.A. or B.S. in economics.

|

School Name |

Location |

Acceptance Rate |

Economics Degree Offered |

|

Chicago, IL |

7% |

B.A. |

|

|

Cambridge, MA |

7% |

B.S. |

|

|

Cambridge, MA |

5% |

B.A. |

|

|

Stanford, CA |

4% |

B.A. |

|

|

Princeton, NJ |

5% |

B.A. |

|

|

New Haven, CT |

6% |

B.A. |

|

|

Pasadena, CA |

7% |

B.S. |

|

|

Berkeley, CA |

15% |

B.A. |

|

|

Hanover, NH |

9% |

B.A. |

|

|

Williamstown, MA |

13% |

B.A. |

If you want to find more schools that offer economics majors, check out Collegevine’s search tool. This free tool allows you to narrow your search by major, as well as by diversity, location, and cost of attendance, to find schools that fit your needs.

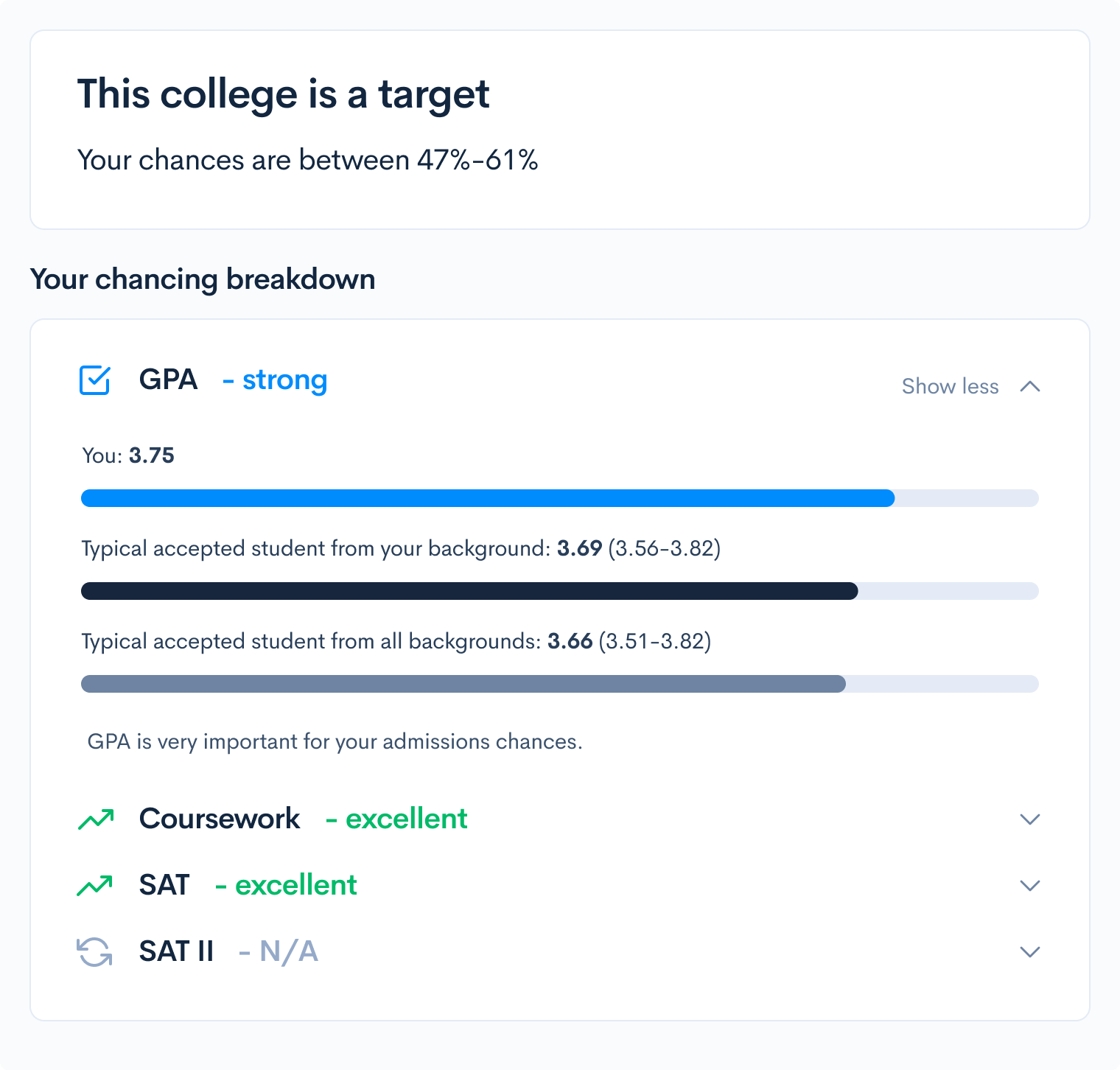

Do you want to know your chances of getting into the schools on your college list? CollegeVine’s free changing engine can help! Our chancing engine factors in your GPA, extracurriculars, test scores, and more to determine your chances of admission at colleges across the country.

Economics Major Career Paths

Now that you know the best schools for Economics majors, let’s look at the most popular career paths for those who complete the major.

1. Economist

Median Salary: $108,350

Project growth (2019-2029): 14%

If you loved your economics classes in college and especially enjoyed the theories behind economics, you should consider becoming a professional economist. Economists collect data on resource trends and evaluate the underlying economic issues of government policy. This job would be well suited for someone who wants to apply what they learned in college to the real-world. Typically, economists have graduate degrees, so you may want to consider applying for graduate school.

2. Management Consultant

Median Salary: $87,660

Project growth (2019-2029): 11%

Management consultants analyze how a business could improve operationally and determine how it could become more efficient. Consultants enjoy working in a team to complete fast-paced work and meet the needs of their many clients in a variety of industries.

3. Actuary

Median Salary: $111,030

Project growth (2019-2029): 18%

Actuaries use statistics and math to assess a company’s level of risk. If you enjoy the more quantitative aspect of economics, a career as an actuary could be right for you. In fact, many actuaries are economists who apply economic concepts to real-life problems in order to understand the financial impact of risks.

4. Policy Analyst

Median Salary: $125,350

Project growth (2019-2029): 6%

Policy analysts conduct research on laws and regulations to determine how certain policies impact individuals and businesses. An economics degree is useful for this career as it gives a foundation in how the economy functions, especially when considering the financial markets or the labor market. Policy analysts enjoy research and educating the public on what new laws mean for them.

5. Market Research Analyst

Median Salary: $65,810

Project growth (2019-2029): 18%

Market research analysts look into trends to determine why a product or service may or may not be selling, and then advise companies appropriately. Market research analysts enjoy their jobs as they are constantly investigating successful business models, and how they can be improved.

Linked here is a full list of career opportunities for economics majors. Although these are some of the most common careers for economics majors, you should not feel limited by this list. In fact, the economics major is one of the most flexible majors as students pursue a wide variety of careers post-graduation.