10 Hardest AP Macroeconomics Questions

What’s Covered:

- How Will AP Scores Impact My College Chances?

- Overview of the AP Macroeconomics Exam

- 10 Hardest AP Macroeconomics Questions

- Final Tips

The AP Macroeconomics Exam is fairly tricky compared to other AP exams, with 63.3% of students receiving a score of 3 or higher in 2020 but only 19.7% of students receiving a 5. The exam requires students to complete difficult economics problems in a limited time. In this post, we’ll cover some of the trickier macroeconomics problems, and provide detailed explanations of how to solve them.

How Will AP Scores Impact My College Chances?

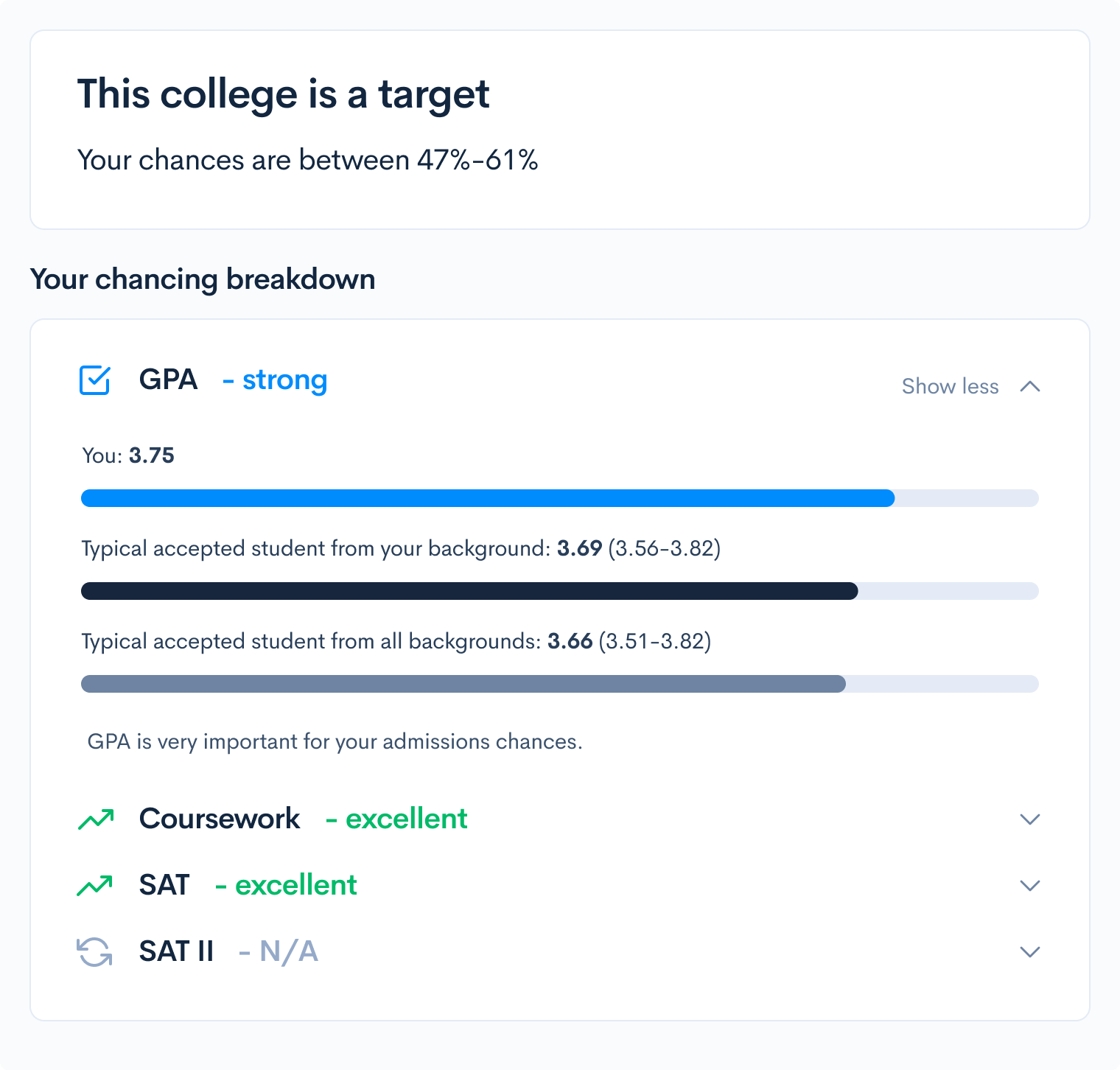

When it comes to your chances of admission, AP scores actually don’t have much of an impact. Instead, colleges look for the classes themselves. Having a lot of AP classes on your transcripts shows to colleges that you’re challenging yourself by taking the hardest courses available.

To see how the AP classes you’re taking affect your college chances, take a look at CollegeVine’s free Admissions Calculator. This tool takes into account your GPA, standardized test scores, and extracurriculars to determine your chances, and even offers suggestions on how to improve your profile!

Overview of the AP Macroeconomics Exam

The AP Macroeconomics Exam tests your knowledge of the following concepts:

- Basic Economic Concepts (5–10%)

- Economic Indicators and the Business Cycle (12–17%)

- National Income and Price Determination (17–27%)

- Financial Sector (18–23%)

- Long-Run Consequences of Stabilization Policies (20–30%)

- Open-Economy–International Trade and Finance (10–13%)

The AP Macroeconomics Exam has both paper and digital formats in 2021.

The paper administration was held on May 10, 2021:

-

Section I: Multiple Choice, 66.65% of exam score

- 60 questions (70 minutes)

-

Section II: Free Response, 33.35% of exam score

- 3 questions (60 minutes)

The digital administration was held on May 19, 2021, and June 2, 2021:

-

Section I: Multiple Choice, 66.65% of exam score

- 60 questions (70 minutes)

-

Section II: Free Response, 33.35% of exam score

- 3 questions (60 minutes)

For the paper administration, no calculator is allowed, but a calculator is allowed for digital administration. The free-response section of the digital administration will be typed, rather than handwritten.

10 Hardest AP Macroeconomics Questions

Question 1

Answer: E

This question provides a production possibilities curve, which is the combination of goods that can be attained using all the resources.

With these curves, there are three different types of points:

- A point below the curve indicates that not all resources are used

- A point on the curve indicates that all resources are being used to the maximum

- A point above the curve is unattainable since it requires using more resources than are available

So, to answer this question, we’re looking for a point that will lie above the line. Therefore, the correct answer is E, since the point corresponding to 20 parks and 4 gymnasiums is above the production possibilities curve.

Question 2

Answer: B

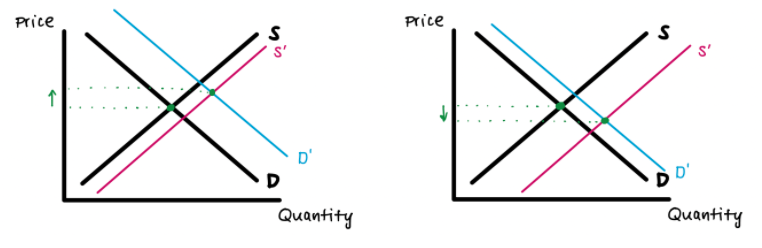

An indeterminate change in equilibrium price means that we are unsure if the price will increase or decrease, given arbitrary changes in supply and demand. Since demand is a downward-sloping curve, an increase in demand will increase the price, and a decrease in demand will decrease the price. Since supply is an upward-sloping curve, an increase in supply will decrease the price, and a decrease in supply will increase the price.

To start, we can eliminate choices D and E. If we are only shifting one curve, then the change cannot be indeterminate (since we know that decreases in demand and supply decrease and increase the equilibrium price, respectively).

Next, answer choice A is incorrect since both an increase in demand and a decrease in supply result in an increase in the equilibrium price, so both of these changes taken together will definitely increase the price. Similarly, answer choice C is incorrect since a decrease in demand and increase in supply both decrease the equilibrium price, so we are confident that the price will decrease as a result of these two changes. But, if we look at answer choice B, we see that an increase in demand increases the equilibrium price, and an increase in supply decreases the equilibrium price. So, if we are unsure of the magnitudes of the changes, we cannot determine for sure whether the equilibrium price increases or decreases.

The following diagram better illustrates this:

As we can see, depending on the exact amounts of change, we could have either an increase or decrease. So, answer choice B results in an indeterminate change.

Question 3

Answer: D

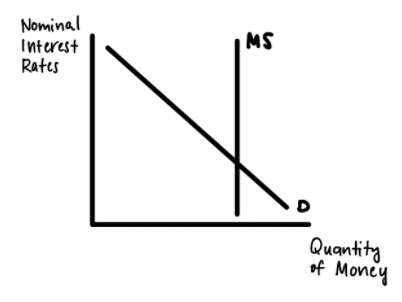

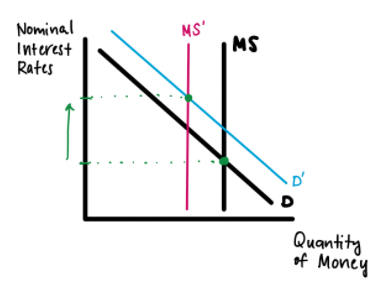

We can start this question by looking at the demand curve. The money market graph can be drawn as follows:

Since demand is downwards-sloping, an increase in demand leads to an increase in nominal interest rates. So, we can automatically eliminate answer choices B and E, since they include a decrease in demand (which will decrease nominal interest rates). Next, an expansionary monetary policy moves the money supply curve to the right, decreasing the nominal interest rates. This eliminates answer choices A, B, and C. So, answer choice D must be correct, and this is true since contractionary monetary policy and increase in demand both raise nominal interest rates, as pictured below:

Question 4

Answer: B

For this question, the correct answer is B, since the reserve requirement is the percentage of deposits that banks are required to hold in the bank and aren’t allowed to loan out. For example, if the reserve requirement is 20%, and the bank receives a deposit of $1,000, the bank is unable to loan out $200 of the total deposit. So, reducing the reserve requirement increases the amount of money that the bank is allowed to loan out, which is what the question is asking.

Question 5

Answer: A

The monetary base is the currency in circulation and the number of reserves in the bank. If a government increases the monetary base, it means that the government is trying to put more money into the economy to multiply it.

This money multiplies because the bank will loan them money to an individual, who may use it to pay a company, which will then pay its employees, who will then spend that money, and so on. So, the money is being moved around and is stimulating the economy.

But, the only way for this to lead to a maximum possible increase is if banks actually loan out all the money besides the reserve requirement. Obviously, this is not always the case, since most banks hold excess reserves (this means that the bank is holding more than what is required by the reserve requirement). Then, not all the money is being loaned out, so increasing the monetary base can’t lead to the maximum possible increase in the money supply.

[amp-cta id="9459"]

Question 6

Answer: C

For this question, the correct answer is C, since If firms are optimistic about the future performance of the economy, they are more likely to get a loan and use that money to start a new project. If the economy is going to perform better in the future, then they will be more confident in their ability to pay off the loan in the future.

Answer A is incorrect since a decrease in investment spending is essentially a decrease in the demand for loanable funds. Answer B is incorrect since a government’s budget surplus doesn’t directly impact companies’ decisions to take out loans. Answer D is incorrect since investing in foreign assets is not relevant to the demand for loanable funds in the domestic country. Finally, answer E is incorrect since political instability isn’t necessarily relevant to the economy. If there is an effect, it would likely be that political instability will cause a negative effect on the economy, which would decrease the demand for loanable funds.

Question 7

Answer: E

A decrease in government expenditures reduces real GDP. This is because we have the following equation: GDP = C + I + G + X – IM. In the equation, G refers to government expenditures. So, decreasing G decreases GDP as well. This means that the answer is B, D, or E.

Next, we can look at the change in interest rates. If the money supply decreases, this might indicate an increase in the interest rates. But, we don’t know how the decrease in government expenditures affects the demand for money. Since we don’t know how the demand will change, we are unable to determine how interest rates will change. So, answer choice E is correct.

Question 8

Answer: E

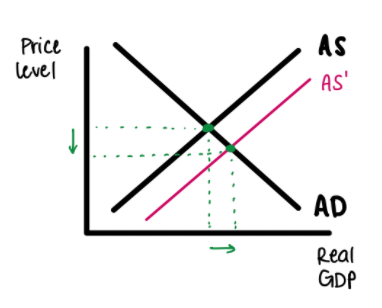

If we want to increase real GDP and decrease the price level, we need to increase aggregate supply (i.e. shifting the AS curve to the right):

Answer choice A is incorrect since a budget surplus will not affect supply. Answer choice B is incorrect since an increase in real interest rates decreases demand, which is not what we want. Answer choice C is incorrect since increasing income tax rates will also decrease demand. Answer choice D is incorrect since increasing the price of the economy’s productive resources will decrease supply since companies will be discouraged from producing their goods due to the higher cost of resources. Answer choice E is the correct answer since increasing productivity of resources encourages companies to produce goods, increasing supply, which is what we wanted.

Question 9

Answer: B

If the economy experiences an improvement in technology, the same amount of resources will be more efficient, which shifts the PPC curve outward. So, answer choices A, C, and E are incorrect. In the long run, we will also be more efficient, so the long-run aggregate supply curve should also shift outwards. This leaves us with answer choice B. In general, improvement in technology typically correlates to outwards shifts, so keep this in mind as you’re taking the AP Macroeconomics Exam.

Question 10

Answer: B

This question is more mathematically involved than the others. Also, the population of the country is not necessary to determine the unemployment rate, so be careful when answering these types of questions since the AP Macroeconomics Exam often throws in miscellaneous information. To find the unemployment rate, we can use the following formula: Unemployment rate = (Labor force – Employed)/Labor force. So, (200,000 – 175,000)/175,000 = .125. Then, the unemployment rate is .125*(100) = 12.5%.

Final Tips

Know your graphs

Graphing is arguably the most important skill you’ll need on this exam. You’ll not only be required to analyze graphs that are given to you, but you might have to create your own. A question might not explicitly ask you to graph, but graphing may be a necessary intermediate step to determine the correct answer.

So, make sure to brush up on your graphing skills and memorize the general formats of the different types of graphs you’ll be tested on. This will ensure that you won’t miss any easy points and will be better equipped to tackle the macroeconomics questions.

Read questions carefully

While this is true for any AP exam, it’s especially important for the AP Macroeconomics Exam. These questions often contain additional information that is not relevant to the problem or may have a small detail that is actually of great significance.

So, to ensure the best chances of success, make sure you are reading and rereading each question carefully. Sometimes the most simple questions are easily missed due to misreading or another careless error. As you take practice exams, try to practice active reading (i.e. underlining or circling important information) so that it becomes a habit.