How to Choose a Major: Finance vs. Economics

What’s Covered:

- Overview of Finance vs. Economics

- How to Prepare for Finance and Economics in High School

- The College Experience: Finance vs. Economics

- After College: Finance vs. Economics

One big choice you’ll have to make when going to college is deciding on your major. To pick this, you want to think about what you’re interested in as well as what fields have solid career options and projections.

If you love math and analytical thinking, then two options you may want to consider are finance and economics. Learn more about finance and economics majors in this post so you can determine which one may be the best fit for you.

Overview of Finance vs. Economics

Whether you choose finance or economics, you’ll be learning similar skills. Both majors will have a lot of the same core classes, such as Introduction to Business or Accounting 101. As you advance in your major, you’ll take different courses like financial management for a finance major and macroeconomics for an economic major. Students in both of these majors will need to make sure to develop similar skills to succeed in future careers such as:

- Problem solving

- Logical thinking

- Ability to analyze lots of data and numbers

- Time management skills

- Knowledge of spreadsheet programs and best practices

- Communication skills

- Qualitative and statistical analysis skills

You’ll learn the other needed skills as you progress through the courses in your chosen major, and continue to develop them as you grow professionally after college. Finance and economics will both have overlap as they are related disciplines; however, there are some distinctions worth mentioning.

Economics Major

As an economics major you’ll take a global, national, and local view of markets and what makes them work. You will learn about capitalism and other systems that drive a nation’s economy. An economist takes a look at the big picture. It’s important to keep in mind that economics is actually a social science that explores how goods and services are exchanged and how human behavior affects these dynamics. There’s still a lot of math involved, even though it is considered a social science.

Economics breaks down into both macro and microeconomics. Macroeconomics focuses on the larger economy itself, while microeconomics examines individuals and organizations. As an economics major, you’ll usually have the opportunity to focus on one of the two.

Finance Major

Finance takes a look at financial systems. Specifically, the major explores money management and creation, as well as credit, investments, assets, banks, and more. There are three types of finance: personal finance, corporate finance, and public finance. You’ll have to determine which type you’d like to do. Personal finance involves managing money of individuals, corporate finance involves working with the assets and liabilities of a business, and public finance deals with tax systems and other aspects of a government’s finances.

How to Prepare for Finance and Economics in High School

In high school, if you want to start preparing early on for a finance or an economics major, then you will want to put your focus on mathematics courses. Since math is a core part of both areas, colleges will want to see that you have not only succeeded, but also excelled in math. This may involve taking honors courses or AP courses in math and economics.

Along with your coursework, you may want to reach out to local businesses to see if any of them offer internships within their finance department or if your city has an internship in economics. This can help differentiate you from other applicants as it shows that you’ve actively worked to seek out opportunities outside of the classroom. Volunteering can also be important to colleges as they like to see community involvement. Consider using your time to help teach math to underprivileged children or to tutor someone who may be struggling with learning the concepts they’ve seen in class.

Additionally, join any clubs that your school may have that are centered around math. For example, many schools have competitive math teams that travel around to compete with other schools in tournaments, for example, Academic Decathlon. Joining service-based organizations such as Beta Club and National Honors Society may also boost your application.

The College Experience: Finance vs. Economics

Although there is some overlap, finance and economics majors have distinctive courses.

Common courses you’ll take as a finance major include corporate finance, financial reporting, strategic management, financial modeling, investment analysis, and money and banking.

As an economics major, you’ll be in courses like American economic history, international economics, price theory, economic principles, game theory, and econometrics.

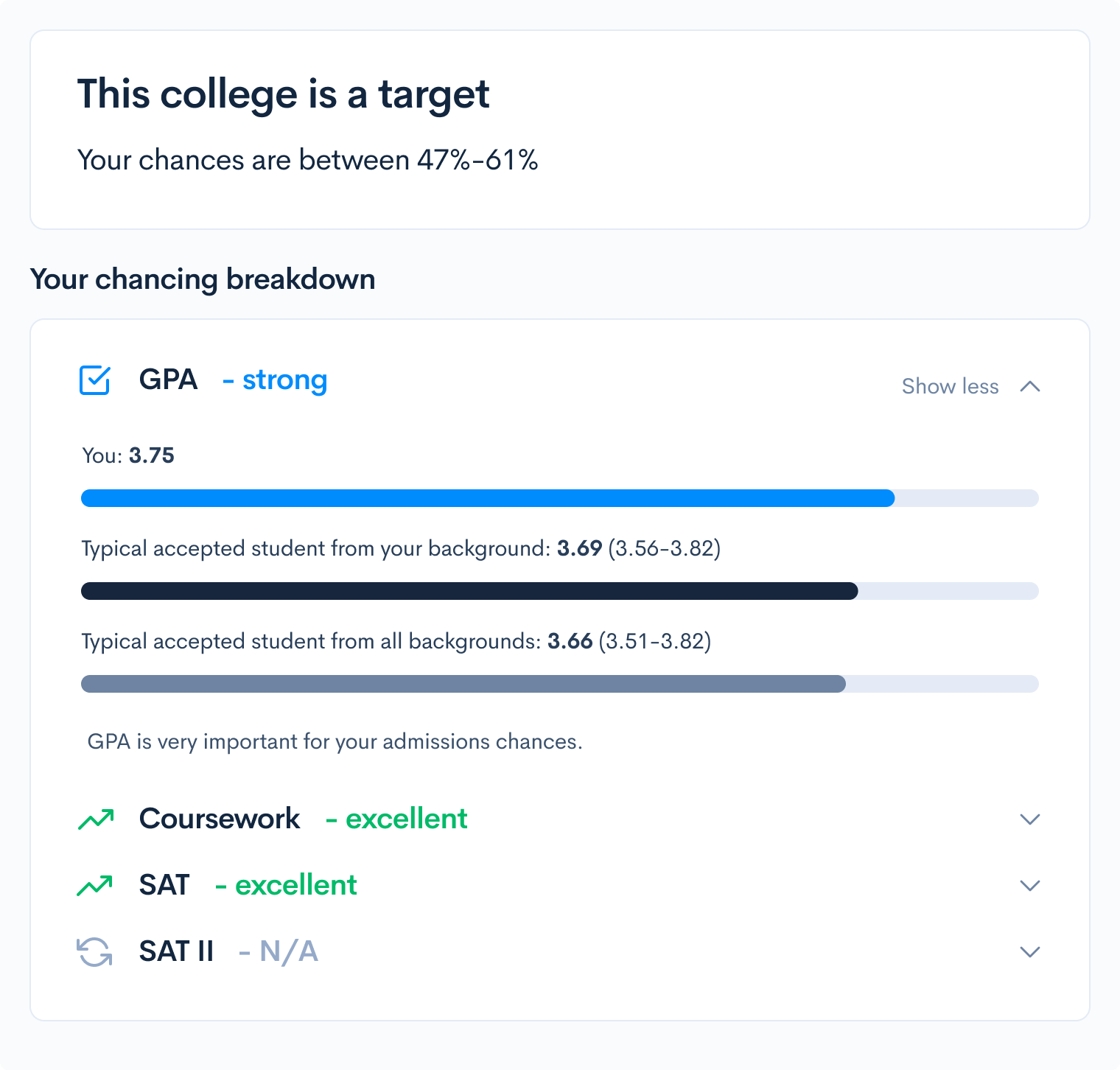

Once you’ve decided on a major, you’ll need to search for a university that offers your major and has a good reputation in the field. Along with that, though, you’ll need to determine what university meets your other needs. For example, do you want a college with a vibrant student life program? Is student body diversity very important to you? Using online tools from CollegeVine like the school search tool can help you find schools based on size, location, diversity, and other important factors. You can also use our chancing tool to determine your approximate chances of getting into your chosen school, as well as implement any suggestions the tool may make for you.

Look up all the information you can find about the college you want to attend. You’ll need to know about all of the course requirements and just how rigorous the curriculum will be so that you can implement a time management process.

You’ll also want to choose a school based on its faculty, especially in the world of finance and economics. These faculty, and the alumni, may be able to help you network and find a good job as soon as you graduate.

Some of the top best schools for finance in the country include:

- Harvard University

- Massachusetts Institute of Technology

- Princeton University

- University of Pennsylvania

- Stanford University

If you’re focusing on business and want to target the top five best schools for business, then you will want to look at universities such as:

- University of Pennsylvania

- Cornell University

- California Institute of Technology

- Washington University in St. Louis

- Carnegie Mellon University

After College: Finance vs. Economics

Once you’ve graduated, you may decide to go on to obtain your MBA or even a doctorate degree, particularly if you wish to pursue a career in academia as a university professor. If you’d rather enter the private sector, there are also many jobs you can take right out of college without obtaining a postsecondary degree.

Economists, according to the Bureau of Labor Statistics, should have relative job security in the next decade. By 2029, the field is projected to grow by 14 percent, much higher than average. In May 2020, people in this role were making a median salary of $108,350 annually. Other types of jobs that economics majors may have include:

- College professor

- Actuary

- Political scientist

- Urban and regional planner

- Survey researcher

- Operations research analyst

Business and financial occupations should add more than 400,000 jobs by 2029, and people in these roles make about $72,250 annually, much higher than the average salary of $41,950. Types of jobs that a finance major might land after college could be:

- Accountant

- Auditor

- Cost estimator

- Financial analyst

- Insurance underwriter

- Personal financial advisor

- Purchasing manager

Final Thoughts

No matter which major you choose, you should likely end up in a field with massive potential for growth, both professionally and personally. Take the time in high school to explore your passions and figure out which one you’d prefer more. You may find that you prefer the smaller scale of finance, or the bigger picture of economics. Would you rather work in a business in their finance department or perhaps for yourself as a personal finance advisor? Or would you want to be somewhere where your knowledge can help enact sweeping change, like in a government that relies on economics to make decisions?

Choose the major that you feel most passionate about and go from there. College will give you the time you need to evaluate your choice, and you can even take overlapping courses to help reinforce your decision.