The Complete Guide to Fee Waivers in the College Application Process

What’s Covered:

- Standardized Test Fee Waivers

- College Application Fee Waivers

- How to Prepare to Apply for Fee Waivers

- How to Save Money on College Tuition

Aside from the well-known tuition fees, many additional costs come up during the college applications process. College applications, standardized tests, and some financial aid applications require an additional fee from students.

These costs can be daunting, particularly for low-income students. After all, even if you qualify for college financial aid, it will not apply to any of the pre-college fees.

Luckily, various institutions and organizations offer fee waivers. Each fee waiver has its own requirements and attainment processes, so we’ve outlined the most common ones and their eligibility requirements. The college application process doesn’t have to be expensive with these waivers!

Standardized Test Fee Waivers

SAT Fee Waiver

The SAT waiver covers the cost of up to two SAT’s, two SAT subject test administrations, four score reports, and four college application fee waivers.

To be eligible for this fee waiver, you must meet at least one of the following criteria:

- enrolled in the Federal Free and Reduced Lunch Program (FRPL)

- take part in a federal, state, or local program aiding students from low-income families

- receive public assistance

- live in federally subsidized housing or a foster home or are homeless

- are a ward of the state or an orphan

- have an annual family income below the USDA Income Eligibility Guidelines

If you meet one of the above requirements, simply contact your high school counselor or a representative of an authorized community-based organization to get your fee waiver. The waiver will come in the form of a 12-digit code, which you will enter when you register for the SAT/SAT subject test. For more information, see our post on the SAT waiver.

ACT Test Waiver

The ACT fee waiver covers the two registration fees for both the ACT and writing section. In addition, you get one free score report to your high school and up to four score reports to colleges. This fee waiver also gives students access to extra test prep tools and a Request for Waiver or Deferral of College Admission Application Fee form, which could negate your application fees or one or more universities.

To be eligible for this fee waiver, you must be an 11th or 12th grade student, testing in the United States, and be able to show economic need based on you or your family’s income level. One can show economic need by meeting any of the criteria listed for the SAT Fee Waiver above.

If you qualify, you simply need to contact your high school counselor and fill out an ACT fee waiver form. Once you are approved for the waiver, you’ll be given a serial number. This will serve as an indication of your fee waiver when you register to take the ACT. For more in-depth information, take a look at our post on the ACT fee waiver.

AP Test Waiver

Unfortunately, there is no waiver that covers the entire cost of an AP test. There is, however, a Fee Reduction Program that, thanks to the Every Student Succeeds Act, lowers the cost of each AP test by $33.

To receive this fee reduction, you must prove your financial need by meeting any of the requirements mentioned under “SAT Fee Waiver” or proving that your family is at or below 185 percent of the poverty level issued annually by the US Department of Health and Human Services. Also, if you belong to a school district that is part of The Community Eligibility Provision program, you automatically qualify for the fee reduction.

To learn more about AP Exam Fee Reductions, speak to your high school counselor.

College Application Fee Waivers

College application platforms also offer a waiver option for college application fees. The process of obtaining the waiver may depend on the college or university, and may have some specific requirements other than financial need. You will need to look up each university’s specific fee waiver requirements and plan accordingly, but here’s an overview of two common waivers that many universities use.

Common App Fee Waiver

Common App fee waivers are intended for college applicants whose financial circumstances would pose a major barrier to applying to college. You will need to prove your eligibility for the fee waiver and formally request it through your Common App account. Learn more about the Common App Fee Waiver and whether you qualify.

Coalition Application Fee Waiver

For the Coalition Application, there is a fee waiver component built into the application itself. This consists of a few short questions that will be used to determine whether your financial situation meets the criteria for waiving your application fees. Some colleges have their own requirements as well. For instance, some Coalition Schools require you to be an in-state resident of the college to be eligible for the fee waiver. Be sure to clarify each school’s fee waiver requirements before applying.

Individual Fee Waivers

Some colleges will give out fee waivers to high-achieving students via email or mail. Now is the time to dig through your mountains of college pamphlets or search your inbox for fee waivers. You don’t have to do anything to qualify for these, and colleges send these to students regardless of income.

Financial Aid Fee Waiver

It seems counter-intuitive to have students pay a fee to apply for financial aid. Thankfully, many financial aid applications, particularly the federal ones, agree and don’t charge an application fee. Unfortunately, there is one big exception to this rule: the CSS profile.

A non-federal financial aid form run by CollegeBoard, the CSS Profile is used by many colleges to assess a student’s and their parent’s financial situation. The fee for the initial application is $25, and every additional report of your profile to a college is $16.

There is, however, a fee waiver that covers both the application fees and the reporting fees for up to eight colleges, as long as you are a US citizen or resident. There is no special process for this fee waiver – your candidacy will be decided based on the information you provide in your CSS profile.

Recently, it has become possible to extend your SAT Fee Waiver to the CSS profile fee waiver (and get the same coverage), as long as you log into your CSS profile with the same credentials you used when registering for the SAT, through the College Board.

How should I prepare to apply for waivers?

Every application for fee waivers, like every financial aid application, is different. The most important thing is to do your research on the different fee waivers. You’ll get a much better idea of how you should be preparing if you’ve done your homework.

That being said, there are two things that you should definitely prepare ahead of time, as most fee waiver applications require you to have them.

First, you will need to be able to prove your income level. Income can be proven in a variety of ways, and different fee waiver applications will accept different methods of demonstrating your income. Some common ways include recent tax returns and proof of membership in any federal aid programs.

Second, be sure to speak to a counselor at your high school about applying for waivers. More often than not, they are the ones who know the most about fee waivers and financial aid, and you may need their verification or a supporting statement for some of the applications. You should do this sooner rather than later. As college application deadlines near, high school counselors get extremely busy. You may not be able to get an appointment if you wait too long.

If you know you or your family may struggle with paying for college applications, know that there are many resources and waivers available to you – you just need to know where to look. Before you agree to pay those pesky fees or give up on the application altogether, take a moment to explore your waiver options. You may be eligible for more aid than you think.

How to Save Money on College Tuition

Schools with the highest sticker prices aren’t necessarily the most expensive for your family after financial aid. Many top schools offer generous need-based aid, and it may actually be cheaper to attend a selective private school than your in-state public school for lower-income families. In fact, some students pay nothing to attend top schools like Harvard!

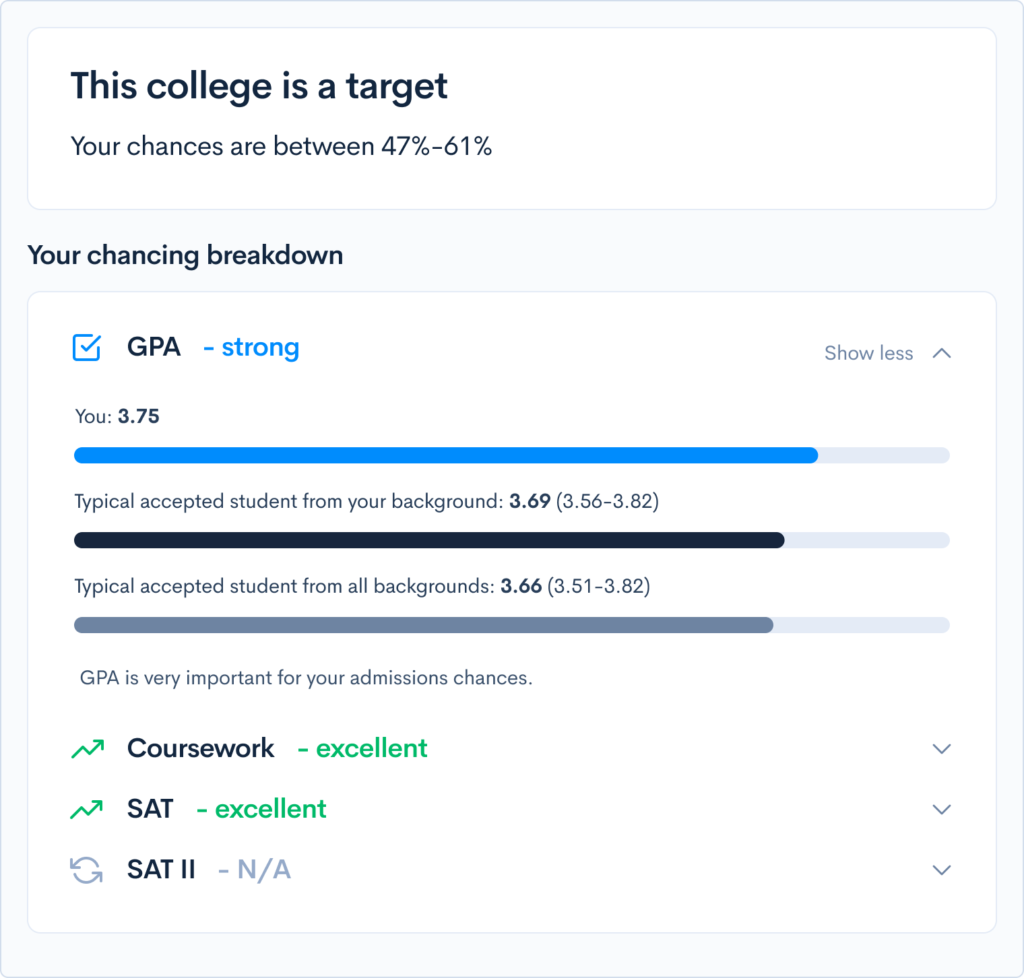

To better understand your cost of attendance, use our free chancing engine. We’ll not only let you know your chances of acceptance, but also how much each school should cost your family, and how you can improve your admissions profile. Give it a try to get a jumpstart on your college journey!